Tri-Segmented Monte Carlo Simulation

[this page | pdf | back links]

Monte Carlo simulation

Financial firms and others who advise or regulate them often

need estimates of the value of portfolios of assets and/or liabilities or of

risk measures quantifying the risks to which such portfolios are exposed.

Common risk measures used to quantify risk for such portfolios include value-at-risk (VaR), expected

shortfall and tail

value-at-risk (TVaR). For portfolios involving sufficiently simple payoffs,

the relevant valuation and risk metrics may be expressible using just

analytical formulae and the runtimes needed to calculate them may be quite low.

However, for more complicated portfolios it is typically necessary to use simulation

techniques. Simulation techniques are also used extensively in non-financial

fields.

The traditional workhorse for this purpose is Monte Carlo

simulation. In its most basic form, simulations are drawn randomly from the

relevant probability distribution(s) characterising the economic drivers

impacting the (present) value of the portfolio payoff. The payoff present

values arising from each simulation are then calculated. The portfolio value is

estimated as the average of these values. The portfolio VaR can be estimated by

identifying the outcome below which only a specified fraction of losses arising

from such simulations lie, in other words, from the relevant percentile

(quantile) of the observed distribution of these simulated losses.

Unfortunately, the accuracy of results derived from (basic)

Monte Carlo simulation exercises typically improves only in proportion to the

square root of the number of simulations used. To improve accuracy 10-fold we

thus need to use 100 times as many simulations. If the portfolio includes many

more complicated assets or liabilities or if nested calculations are involved (in

which quantification of the value of a payoff for a given simulation itself

requires a simulation exercise) runtimes can easily become excessive. Firms may

then use proxy models, approximating full book simulations, for

day-to-day decision-making and monitoring. But proxy modelling comes with other

complications such as a need to select a suitable proxy model and to justify

why that model should be a suitable approximation to a full book simulation for

the purpose in question.

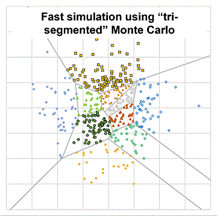

Tri-segmented Monte Carlo

(TSMC)

Nematrian has developed an approach, called tri-segmented

Monte Carlo, that for many relevant problems seems capable of materially improved

runtimes. Instead of applying all simulations to the portfolio, the simulations

are split into 3 subsets, (1) an “underlying”, (2) an “added” and (3) an

“extended” simulation set. The extended set is usually by far the largest of

these three sets. Only the underlying and added sets are actually applied to

the portfolio; the extended set is instead applied to only to a fast to

evaluate approximation derived principally from the underlying simulation set.

The added simulation set helps to correct for inaccuracies in this

approximation.

A presentation summarising tri-segmented (trisegmented)

Monte Carlo is available here: Efficient

Monte Carlo simulation of portfolio value, value-at-risk and other portfolio

metrics.

Demonstration tool

To help organisations unfamiliar with tri-segmented Monte

Carlo (TSMC) understand better how it might help them, Nematrian has included

on its website several Nematrian web service tools:

(a) MnDemoTSMC. This tool provides

a cut-down demonstration version of Nematrian’s full TSMC engine. Users can

enter simulation data and other parameters that are similar in form to a subset

of those needed by the full engine but with size limits on datasets and

parameters to limit the CPU resources required to run the demonstration

version.

(b) MnDemoTSMCSimGen.

This tool allows users to create a simulation set of the sort needed for MnDemoTSMC.

(c) MnDemoTSMCValueSim.

This tool allows users to apply simulations from MnDemoTSMCSimGen to a

simplified portfolio which MnDemoTSMC

uses to illustrate TSMC. The strikes, terms and underlyings of each of the

instruments in this portfolio are available through MnDemoTSMCStrikes, MnDemoTSMCTerms and MnDemoTSMCUnderlyings.

Licensing

If you are interested in licensing this intellectual

property then please speak to your contact at Nematrian or email us at ContactUs@nematrian.com.*

* Please see our Privacy Policy for information

on how we use any personal information such as e-mail addresses that you might

give us.