Derivative Pricing – Semi-Analytic

Lattice Integrator Approaches

1. Introduction

[this page | pdf | references | back links]

Return

to Abstract and Contents

Next

page

1.1 The price of

a (European-style) derivative can be calculated as the discounted expected

value of its payout function, where the expectation is carried out using the

risk-neutral probability distribution. If the payout function and the

risk-neutral probability distribution are both simple functions then the price

of the derivative may be derivable analytically. For example, the Black-Scholes

formulae can be derived analytically (see e.g. Black-Scholes

derivation as the limit of a binomial tree or Black-Scholes

derivation using stochastic calculus). The hedging parameters, i.e. greeks,

applicable to the derivative may also be analytically tractable (see e.g. hedging parameters

applicable to vanilla and binary puts and calls in a Black-Scholes world).

However, for more complicated pay-offs or more complicated risk neutral

probability distributions it is usually not possible to derive equivalent

analytical formulae.

1.2 The most

common approach used to circumvent this problem is to use numerical approaches

such as binomial or trinomial trees that converge to the correct price or other

hedging parameter as the tree becomes more and more finely grained.

Unfortunately, these algorithms are not usually very good at handling

singularities in derivative payout functions. These singularities can arise

directly in the payout function, e.g. payout functions applicable to digital

options have discontinuities at the strike price. They can also arise via

discontinuous first partial derivatives with respect to the underlying (price)

process. These are more common. For example, the first derivative of the payout

function of a vanilla call option is discontinuous at the strike price because

the payoff function has a kink there.

1.3 Some of the

problems these discontinuities create can be mitigated by judicious choice of

where to position the nodes of the relevant tree. However, an arguably better

approach, if it is practical to implement, is to approximate the payoff

function as the sum of components that are analytically tractable. In

particular, it is often possible to find payoff functions with specified domain

limits (i.e. ranges over which they are non-zero) that are analytically

tractable. This leads to the semi-analytic lattice integrator (‘SALI’)

approach, see e.g. Hu, Kerkhof,

McCloud and Wackertapp (2006).

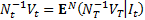

1.4 As with other derivative pricing approaches,

the SALI approach notes that the value,  , of a

(non-dividend paying) derivative at time

, of a

(non-dividend paying) derivative at time  ,

relative to the chosen numeraire asset,

,

relative to the chosen numeraire asset,  ,

satisfies:

,

satisfies:

where  is

the information set (or filtration) generated by the underlying

processes and

is

the information set (or filtration) generated by the underlying

processes and  is

the relevant risk-neutral expectation operator. Usually, we will restrict

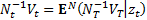

ourselves to Markovian models, in which case the above formula can also be

written as:

is

the relevant risk-neutral expectation operator. Usually, we will restrict

ourselves to Markovian models, in which case the above formula can also be

written as:

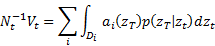

1.5 The observation underlying SALI is that if the

payout can be written as a function of the underlying Markov process then it

can be decomposed into the sum of a finite number of smooth subcomponents i.e.

as:

where  denotes

a (typically) low-dimensional underlying Markov process.

denotes

a (typically) low-dimensional underlying Markov process.

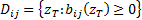

Here the  are

indicator functions, i.e.

are

indicator functions, i.e.  if

if  ,

,  otherwise.

The decomposition might use one smooth function between consecutive

discontinuities, or it might use several that are pasted together, e.g. cublic

spline functions.

otherwise.

The decomposition might use one smooth function between consecutive

discontinuities, or it might use several that are pasted together, e.g. cublic

spline functions.

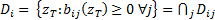

1.6 The pricing problem can thus be re-expressed

as:

where  where

where

.

.  can

in practice be truncated to be within some ‘envelope of support’ that includes

essentially all of the probability density applicable to the pricing problem.

For example, for a Weiner process, one might use an outer envelope spreading

out to, say, four standard deviations, since virtually none of the probability

density is outside this spread. However, care is needed in such a truncation if

the payoff function becomes sufficiently large sufficiently rapidly at the edge

of the distribution, see e.g. the Cost

of Capital pricing model.

can

in practice be truncated to be within some ‘envelope of support’ that includes

essentially all of the probability density applicable to the pricing problem.

For example, for a Weiner process, one might use an outer envelope spreading

out to, say, four standard deviations, since virtually none of the probability

density is outside this spread. However, care is needed in such a truncation if

the payoff function becomes sufficiently large sufficiently rapidly at the edge

of the distribution, see e.g. the Cost

of Capital pricing model.

NAVIGATION LINKS

Contents | Prev | Next