Relative Value-at-Risk (Relative VaR)

[this page | pdf | back links]

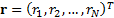

Suppose we want to derive the (relative) portfolio

Value-at-Risk (relative VaR) when returns  on

the

on

the  exposures

are jointly Gaussian, assuming that the corresponding portfolio weights are

exposures

are jointly Gaussian, assuming that the corresponding portfolio weights are  and

corresponding benchmark weights are

and

corresponding benchmark weights are  .

.

By jointly Gaussian we mean that the vector of returns  is

distributed as a multivariate normal distribution

is

distributed as a multivariate normal distribution  ,

where

,

where  is

a vector of mean returns and

is

a vector of mean returns and  is

a covariance matrix.

is

a covariance matrix.

A property of any  -dimensional Gaussian, i.e.

multivariate Normal, distribution that can be derived relatively simply from

the probability density function of such a distribution is that if

-dimensional Gaussian, i.e.

multivariate Normal, distribution that can be derived relatively simply from

the probability density function of such a distribution is that if  and

if we have a constant vector

and

if we have a constant vector  then

then

is

univariate Normal

is

univariate Normal  for

some

for

some  and

and

.

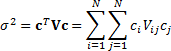

Specifically:

.

Specifically:

where the  are

the elements of the covariance matrix

are

the elements of the covariance matrix  .

.

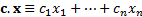

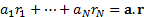

By relative return we mean the return on the portfolio

relative to the return on the benchmark. For any given time period the return

on the portfolio is the weight the portfolio ascribes to the exposure times the

return on that exposure, i.e. is  ,

where

,

where  is

a vector with components

is

a vector with components  .

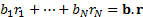

Likewise the return on the benchmark is is

.

Likewise the return on the benchmark is is  ,

where

,

where  is

a vector with components

is

a vector with components  .

So the relative return* is

.

So the relative return* is  .

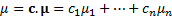

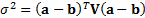

Hence the relative return is distributed as a univariate Normal distribution

with

.

Hence the relative return is distributed as a univariate Normal distribution

with  and

and

.

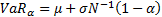

The relative VaR with confidence level

.

The relative VaR with confidence level  is

then

is

then  with

these

with

these  and

and  , where

, where  is

the inverse Normal function.

is

the inverse Normal function.

* N.B. there is an assumption here that the returns over the

relevant time interval are small, otherwise there is an issue about whether to

use arithmetic relative or geometric relatives etc., see e.g. Relative Return

Computations).