Different ways of calculating relative returns

[this page | pdf | back links]

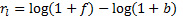

Conventionally, a fund’s return relative to a benchmark

return is calculated as the arithmetic difference between the two (perhaps both

annualised, following some specified annualisation

convention), i.e. as  , where

, where  is

the fund return and

is

the fund return and  is the benchmark

return. This is known as an arithmetic relative return.

is the benchmark

return. This is known as an arithmetic relative return.

Returns compound through time, and hence log returns add

through time. It is therefore usually theoretically more appropriate to focus

on logarithmic relative returns, i.e.:

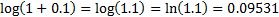

Here,  and

and  need

to be quoted as fractions, i.e. an arithmetic return of 10% is represented by

0.1, and it is conventional to use natural logarithms, so its corresponding log

return is

need

to be quoted as fractions, i.e. an arithmetic return of 10% is represented by

0.1, and it is conventional to use natural logarithms, so its corresponding log

return is  .

.

However, logarithms are not a universally well understood

concept amongst the readers of performance reports, who do not necessarily have

a mathematical or scientific background. A hybrid that is thus commonly used is

to quote geometric relative returns, defined as:

Again,  and

and  need

to be quoted as fractions.

need

to be quoted as fractions.

The Nematrian performance measurement functions generally

allow the user to choose between these different conventions, where relevant.

We may then define corresponding relative risk measures,

such as ex ante tracking error (which is inherently a relative risk measure)

and relative Value-at-Risk (i.e. relative VaR).