Integration of Piecewise Polynomials

against a Gaussian probability density function

[this page | pdf | references | back links]

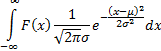

In a number of financial contexts it can be important to

calculate the following integral:

For example, this integral is relevant to calculating

moments of a fat-tailed distribution, i.e. one whose quantile-quantile plot

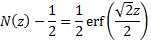

versus the Normal distribution,  ,

is not unity. The faster

,

is not unity. The faster  increases

as

increases

as  the

greater is the impact of fat-tailed behaviour, i.e. deviations from a density

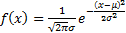

function of the form

the

greater is the impact of fat-tailed behaviour, i.e. deviations from a density

function of the form  .

Thus risk measures such as expected shortfall (effectively a first moment

computation, in which the leading element of

.

Thus risk measures such as expected shortfall (effectively a first moment

computation, in which the leading element of  is

of order

is

of order  )

are more sensitive to fat-tailed effects than Value-at-Risk risk measures

(effectively a zero moment computation, in which the leading element of

)

are more sensitive to fat-tailed effects than Value-at-Risk risk measures

(effectively a zero moment computation, in which the leading element of  is

of order

is

of order  ).

).

This integral can also appear in derivative pricing

analysis, if payoff is being approximated by a piecewise polynomial function

and the movement of the underlying is of a certain type (but see Valuing

polynomial payoffs in a Black Scholes World, which suggests that some

modification may be needed to cater for exponentials arising when converting

the partial differential equation arising under a Gauss-Weiner process to one

with ‘standard’ parabolic form).

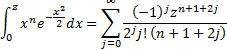

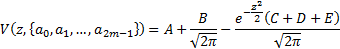

Hence, it becomes helpful to be able to calculate the

following integral rapidly:

If  is

large then we note that:

is

large then we note that:

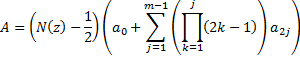

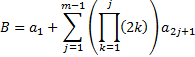

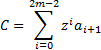

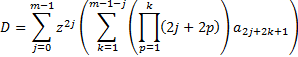

Where

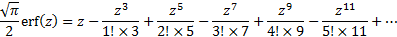

If  is

small then for higher order coefficients the above computation runs into

machine rounding problems. It is then better to use a Taylor series expansion,

bearing in mind that:

is

small then for higher order coefficients the above computation runs into

machine rounding problems. It is then better to use a Taylor series expansion,

bearing in mind that:

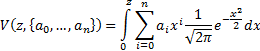

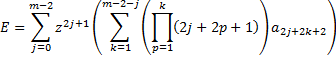

Hence (if  is

integral and

is

integral and  )

we have:

)

we have: