Finding The Most Important Principal

Component

[this page | pdf | back links]

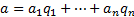

Suppose we have a set of  series

of returns (or losses, …). A principal component is a set of exposures (and a

principal component series is a series of returns) corresponding to an

eigenvector of the relevant

series

of returns (or losses, …). A principal component is a set of exposures (and a

principal component series is a series of returns) corresponding to an

eigenvector of the relevant  covariance

matrix,

covariance

matrix,  .

Eigenvectors satisfy the vector equation

.

Eigenvectors satisfy the vector equation  for

some scalar

for

some scalar  .

.

Typically principal components are identified in practice

using suitable software packages designed to identify eigenvectors and

eigenvalues, applied to the relevant covariance matrix,  ,

e.g. using using Nematrian web services functions that target principal

components, i.e. MnPrincipalComponents,

MnPrincipalComponentsSizes

and MnPrincipalComponentsWeights.

,

e.g. using using Nematrian web services functions that target principal

components, i.e. MnPrincipalComponents,

MnPrincipalComponentsSizes

and MnPrincipalComponentsWeights.

However, for the first, i.e. most important, principal

component there is a conceptually simpler approach as follows.

We note that any vector can be written as a combination of

the eigenvectors of a matrix, and that these eigenvectors can be chosen to be

orthonormal (if suitably chosen if some eigenvalues take the same value) so we

can write any vector,  ,

of active positions as the sum of positions,

,

of active positions as the sum of positions,  ,

in the relevant eigenvectors,

,

in the relevant eigenvectors,  ,

i.e. as:

,

i.e. as:

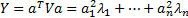

Then,  .

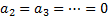

If we order the eigenvectors (principal components) so that the most important

ones are first, i.e.

.

If we order the eigenvectors (principal components) so that the most important

ones are first, i.e.  then

then

is

maximised, subject to

is

maximised, subject to  ,

if

,

if  and

and

.

Thus, we can identify the most important principal component by reference to

the set of positions of unit magnitude that exhibit the largest risk (here

equated with ex-ante tracking error/variance/VaR).

.

Thus, we can identify the most important principal component by reference to

the set of positions of unit magnitude that exhibit the largest risk (here

equated with ex-ante tracking error/variance/VaR).