Deriving the principal components of two

uncorrelated return series

[this page | pdf | back links]

Suppose the returns on two uncorrelated series are  and

and

.

It is assumed that we want an analytical solution rather than a numerical

solution (a numerical solution can be found using Nematrian web services

functions that target principal components, i.e. MnPrincipalComponents,

MnPrincipalComponentsSizes

and MnPrincipalComponentsWeights).

.

It is assumed that we want an analytical solution rather than a numerical

solution (a numerical solution can be found using Nematrian web services

functions that target principal components, i.e. MnPrincipalComponents,

MnPrincipalComponentsSizes

and MnPrincipalComponentsWeights).

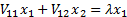

For a two series problem, if the covariance matrix is  then

the principal components are associated with the eigenvectors and eigenvalues

of the covariance matrix, i.e. with values of

then

the principal components are associated with the eigenvectors and eigenvalues

of the covariance matrix, i.e. with values of  that

satisfy, for some vector

that

satisfy, for some vector  the

equation

the

equation  .

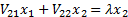

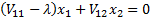

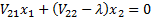

The

.

The  therefore

satisfy the following equations:

therefore

satisfy the following equations:

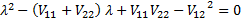

This means that  and

and

,

i.e. (since

,

i.e. (since  for

a covariance matrix):

for

a covariance matrix):

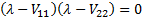

In this instance, the two series are uncorrelated and therefore

.

The quadratic then becomes

.

The quadratic then becomes  ,

i.e.

,

i.e.  or

or

.

The (population) covariance matrix is

.

The (population) covariance matrix is  ,

which thus has two eigenvalues

,

which thus has two eigenvalues  and

and

and

associated eigenvectors which are of the form

and

associated eigenvectors which are of the form  and

and

respectively

for arbitrary

respectively

for arbitrary  and

and

.

The first principal component is associated with whichever of

.

The first principal component is associated with whichever of  and

and

is

the larger, and the second principal component with the other one.

is

the larger, and the second principal component with the other one.

If we want principal components that are orthonormal return

series and portfolio exposures that correspond to these principal components

then the portfolio exposures must have  for

for

and

2, which means in this instance that

and

2, which means in this instance that  and

and

.

If we choose

.

If we choose  then

the resulting return series are merely de-meaned versions of the original

series, i.e. are are

then

the resulting return series are merely de-meaned versions of the original

series, i.e. are are  and

and

or

vice-versa depending on whether

or

vice-versa depending on whether  or

or

.

.