Enterprise Risk Management Formula Book

5. Statistical Methods

[this page | pdf | back links]

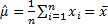

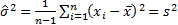

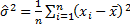

5.1 Sample moments

A random sample of  observations

observations  has (equally

weighted) sample moments as follows:

has (equally

weighted) sample moments as follows:

‘Population’ moments (e.g. population variance,

population skewness,

population excess

kurtosis) are calculated as if the distribution from which the data was

being drawn was discrete and the probabilities of occurrence exactly matched

the observed frequency of occurrence.

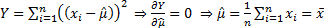

The least squares estimator for parameters of a distribution

are the values of the parameters that minimise the square of the residuals, so

the least squares estimator for the mean,  , is the value

that minimises

, is the value

that minimises

Non-equally weighted moments give different weights to

different observations (the weights not dependent on the ordering of the

observations), e.g. the sample non-equally weighted mean (using

weights  ) is:

) is:

5.2 Parametric inference (with an underlying

following the normal distribution)

One sample:

For a single (equally weighted) sample of size  ,

,

, where

, where  then the

following statistics are distributed according to the Student’s t

distribution and the chi-squared distribution:

then the

following statistics are distributed according to the Student’s t

distribution and the chi-squared distribution:

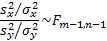

Two samples:

For two independent samples of sizes  and

and

,

,  and

and  , where

, where  and

and  then the

following statistic is

distributed according to the F distribution:

then the

following statistic is

distributed according to the F distribution:

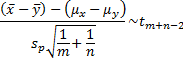

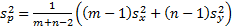

If  then:

then:

where  is the pooled

sample variance.

is the pooled

sample variance.

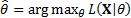

5.3 Maximum likelihood estimators

If  is the maximum likelihood estimator

of a parameter

is the maximum likelihood estimator

of a parameter  based on a

sample

based on a

sample  then

then

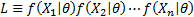

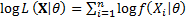

where  is the

likelihood for the sample, i.e.

is the

likelihood for the sample, i.e.  and hence

and hence

is

asymptotically normally distributed with mean

is

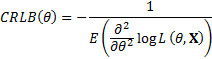

asymptotically normally distributed with mean  and

variance equal to the Cramér-Rao lower bound

and

variance equal to the Cramér-Rao lower bound

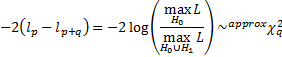

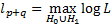

Likelihood ratio test:

where  is the

maximum log-likelihood for the model under

is the

maximum log-likelihood for the model under  (with

(with  free

parameters) and

free

parameters) and  is the

maximum log-likelihood for the model under

is the

maximum log-likelihood for the model under  (with

(with  free

parameters). Non-equally weighted estimators can be identified by weighting the

free

parameters). Non-equally weighted estimators can be identified by weighting the

terms

appropriately.

terms

appropriately.

5.4 Method-of-moments estimators

Method of moments estimators are the parameter values

(for the  parameters

specifying a given distributional family) that result in replication of the

first

parameters

specifying a given distributional family) that result in replication of the

first  moments of

the observed data. For the normal distribution these involve

moments of

the observed data. For the normal distribution these involve  and either

and either  (the sample

variance, if a small sample size adjustment is included) or

(the sample

variance, if a small sample size adjustment is included) or  (the

‘population’ variance, if the small sample size adjustment is ignored and we

select the estimators to fit

(the

‘population’ variance, if the small sample size adjustment is ignored and we

select the estimators to fit  and

and  . In the generalised

method of moments approach we select parameters that ‘best’ fit the

selected moments (given some criterion for ‘best’), rather than selecting

parameters that perfectly fit the selected moments.

. In the generalised

method of moments approach we select parameters that ‘best’ fit the

selected moments (given some criterion for ‘best’), rather than selecting

parameters that perfectly fit the selected moments.

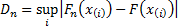

5.5 Goodness of fit

Goodness of fit describes how well a statistical model fits

a set of observations. Examples include the following, where  is the

is the  ’th

order statistic,

’th

order statistic,  is the

supremum (i.e. largest value) of the set

is the

supremum (i.e. largest value) of the set  ,

,  is

the cumulative distribution function of the distribution we are fitting and

is

the cumulative distribution function of the distribution we are fitting and  is the

empirical distribution function:

is the

empirical distribution function:

(a) Kolmogorov-Smirnov

test:  . Under the

null hypothesis (that the sample comes from the hypothesized distribution), as

. Under the

null hypothesis (that the sample comes from the hypothesized distribution), as  then

then

tends to a

limiting distribution (the Kolmogorov distribution).

tends to a

limiting distribution (the Kolmogorov distribution).

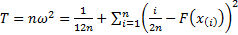

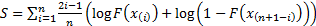

(b) Cramér-von-Mises test:

(c) Anderson-Darling test:

where

where

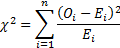

If data is bucketed into ranges then we may also use

(Pearson’s) chi-squared goodness of fit test using the following test

statistic, where  is the sample

size and

is the sample

size and  is the

observed count,

is the

observed count,  is the

expected count and

is the

expected count and  and

and  are the lower

and upper limits for the

are the lower

and upper limits for the  ’th bin. The test

statistic follows approximately a chi-squared distribution with

’th bin. The test

statistic follows approximately a chi-squared distribution with  degrees

of freedom, i.e.

degrees

of freedom, i.e.  where

where  is

the number of non-empty cells and

is

the number of non-empty cells and  is the number

of estimated parameters plus 1:

is the number

of estimated parameters plus 1:

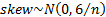

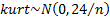

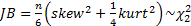

We may also test whether the skew or kurtosis or the two

combined (the Jarque-Bera test) appear materially different from what would be

implied by the relevant distributional family. If the null hypothesis is that

the data comes from a normal distribution then, for large  ,

,

,

,  and

and  .

.

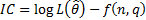

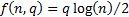

The Akaike

Information Criterion (AIC) (and other similar ways of choosing between

different types of model that trade-off goodness of fit with model complexity,

such as the Bayes Information Criterion, BIC) involves selecting the

model with the highest information criterion of the form  where there

are

where there

are  unknown

parameters and we are using a data series of length

unknown

parameters and we are using a data series of length  for

fitting purposes. For the AIC

for

fitting purposes. For the AIC  and for the

BIC

and for the

BIC  .

.

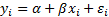

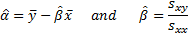

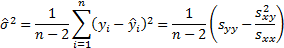

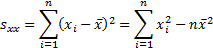

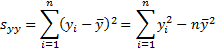

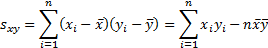

5.6 Linear regression

In the univariate case suppose  where

where  ,

,  then

(equally weighted) estimates of

then

(equally weighted) estimates of  and

and  are:

are:

where

Also

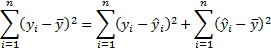

The individual expected responses are  and satisfy

the following ‘sum of squares’ relationship:

and satisfy

the following ‘sum of squares’ relationship:

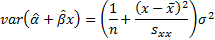

The variance of the predicted mean response is:

The variance of a predicted individual response is the

variance of the predicted mean response plus an additional  .

.

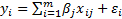

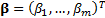

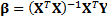

For generalised least squares, if we have  different

series each with

different

series each with  observations

we are fitting

observations

we are fitting  then the

vector of least squares estimators,

then the

vector of least squares estimators,  is given by

is given by  where

where  is a

is a  matrix

with elements

matrix

with elements  and

and  is an

is an  dimensional

vector with elements

dimensional

vector with elements  .

.

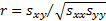

5.7 Correlations

The observed (sample) correlation coefficient

(i.e. Pearson correlation coefficient) between two series of equal

lengths indexed in the same manner  and

and  is (where

is (where  ,

,  and

and  are as given

in the section on linear regression):

are as given

in the section on linear regression):

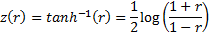

If the underlying correlation coefficient,  ,

is zero and the data comes from a bivariate normal distribution then:

,

is zero and the data comes from a bivariate normal distribution then:

For arbitrary  (

( )

the Fisher z transform

is

)

the Fisher z transform

is  where:

where:

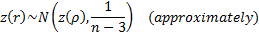

If the data comes from a bivariate normal distribution then  is

distributed approximately as follows:

is

distributed approximately as follows:

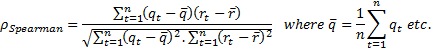

Two non-parametric measures of correlation are:

-

Spearman’s

rank correlation coefficient, where  and

and  are the ranks

within

are the ranks

within  and

and  of

of

and

and  respectively:

respectively:

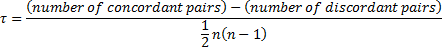

-

Kendall’s

tau, where computation is taken over all  and

and

with

with  and

(for the moment ignoring ties) a concordant pair is a case where

and

(for the moment ignoring ties) a concordant pair is a case where  and a

discordant pair is a case where

and a

discordant pair is a case where  :

:

There are various possible ways of handling ties in these

two non-parametric measures of correlation (ties should not in practice arise

if the random variables really are continuous).

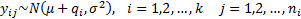

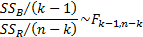

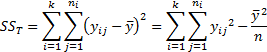

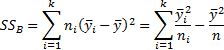

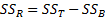

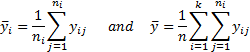

5.8 Analysis of variance

Given a single factor normal model

where  with

with  .

.

Variance estimate:

Under the null hypothesis given above

where:

5.9 Bayesian priors and posteriors

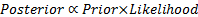

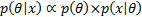

Posterior and prior distributions are related as follows:

i.e.

For example, if  is a random

sample of size

is a random

sample of size  from a

from a  where

where  is known and

the prior distribution for

is known and

the prior distribution for  is

is  then the

posterior distribution for

then the

posterior distribution for  is:

is:

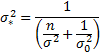

where  is

‘credibility weighted’ as follows:

is

‘credibility weighted’ as follows:

and

NAVIGATION LINKS

Contents | Prev | Next