Enterprise Risk Management Formula Book

10. Portfolio optimisation

[this page | pdf | back links]

10.1 Mean-variance

portfolio optimisation

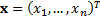

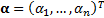

If there are  asset

categories then a (one period) mean-variance efficient portfolio,

asset

categories then a (one period) mean-variance efficient portfolio,  where

where  is the

amount (or weight) invested in the

is the

amount (or weight) invested in the  ’th asset,

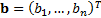

given a benchmark,

’th asset,

given a benchmark,  , assumed

future (one period) mean returns on each asset,

, assumed

future (one period) mean returns on each asset,  , and an

assumed covariance matrix between the (one period) returns on different assets,

, and an

assumed covariance matrix between the (one period) returns on different assets,

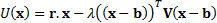

, is a

portfolio that maximises the utility function,

, is a

portfolio that maximises the utility function,  for some

risk aversion parameter,

for some

risk aversion parameter,  , subject

to relevant constraints on the

, subject

to relevant constraints on the  , where:

, where:

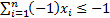

The constraints that are applied are usually linear, i.e. of

the form  which if

which if  is an

is an  dimensional

vector is understood as meaning that there are

dimensional

vector is understood as meaning that there are  constraints

each of the form

constraints

each of the form  . In such a

formulation, equality constraints, including that the amounts invested add up

to the total portfolio value (or the weights add to unity), can be written as

two inequality constraints, e.g.

. In such a

formulation, equality constraints, including that the amounts invested add up

to the total portfolio value (or the weights add to unity), can be written as

two inequality constraints, e.g.  and

and  combined.

combined.

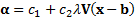

The implied alphas with a mean-variance risk-return model

given a portfolio  and

benchmark

and

benchmark  are the

mean returns that need to be assumed for the different asset categories for

are the

mean returns that need to be assumed for the different asset categories for  to be

mean-variance optimal for some value of

to be

mean-variance optimal for some value of  . They can

only meaningfully be determined for assets whose weights in the portfolio are

not constrained (other than by the constraint that weights add to unity). They

are then

. They can

only meaningfully be determined for assets whose weights in the portfolio are

not constrained (other than by the constraint that weights add to unity). They

are then  where

where  where

where  and

and  are

arbitrary scalar constants.

are

arbitrary scalar constants.

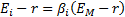

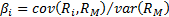

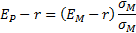

10.2 Capital Asset Pricing Model (CAPM)

The security market line is:

where

The capital market line (for efficient portfolios) is:

NAVIGATION LINKS

Contents | Prev | Next