Enterprise Risk Management Formula Book

11. Extreme value theory

[this page | pdf | back links]

See also here.

11.1 Maximum domain of attraction (MDA)

Suppose that i.i.d. random variables  have cdf

have cdf  . Suppose also

that there exist sequences

. Suppose also

that there exist sequences  and

and  and a cdf

and a cdf  such that:

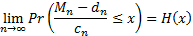

such that:

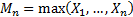

where  is the random

variable corresponding to the block maximum for blocks of such variables of

length

is the random

variable corresponding to the block maximum for blocks of such variables of

length  , i.e. each

(independent) realisation of the series

, i.e. each

(independent) realisation of the series  is used to

create a realisation of

is used to

create a realisation of  given by

given by  .

.

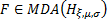

Then  is said to be

in the maximum domain of attraction (MDA) of

is said to be

in the maximum domain of attraction (MDA) of  ,

written

,

written

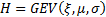

11.2 Fisher-Tippett theorem

If  where

where  is

a non-degenerate cdf then

is

a non-degenerate cdf then  must be a

Generalised Extreme Value (GEV) distribution.

must be a

Generalised Extreme Value (GEV) distribution.

If  where

where  then by

replacing

then by

replacing  by

by  and

and  by

by  we see that

we see that  where

where  .

.

11.3 The Pickands-Balkema-de Haan (PBH) theorem

Let  be the

maximum limiting value of the random variable

be the

maximum limiting value of the random variable  .

Then the PBH theorem states that we can find a function

.

Then the PBH theorem states that we can find a function  such that

such that

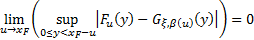

if and only if that

11.4 Estimating tail distributions

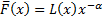

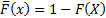

Suppose that the underlying loss distribution is in the

maximum domain of attraction of the Frechét distribution and it has a tail of

the form:  for some

slowly varying

for some

slowly varying  , where

, where  . Then the

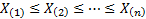

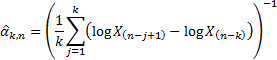

Hill estimator for the (upper) tail index, given

. Then the

Hill estimator for the (upper) tail index, given  ordered

observations,

ordered

observations,  , assuming

that the (upper) tail contains

, assuming

that the (upper) tail contains  entries is:

entries is:

NAVIGATION LINKS

Contents | Prev | Next