Derivation of the Cornish-Fisher

asymptotic expansion

[this page | pdf | references | back links]

A common methodology within risk management circles for

estimating the shape of a fat-tailed return distribution is to make use of the

Cornish-Fisher asymptotic expansion, see e.g. Abramowitz

and Stegun (1970). The Cornish Fisher asymptotic expansion in effect takes

into account non-Normality, and thus by implication moments higher than the

second moment, by using a formula in which terms in higher order moments

explicitly appear. Most commonly the focus is on the fourth-moment version of

this expansion, since it merely uses moments up to and including kurtosis. In

effect, the fourth-moment Cornish Fisher approach aims to provide a reliable

estimate of the distribution’s entire quantile-quantile plot merely from the

first four moments of the distribution, i.e. its mean, standard deviation, skew

and kurtosis.

The approach works as follows. Let  be identically

distributed random variables. Let the cumulative distribution function of

be identically

distributed random variables. Let the cumulative distribution function of  be denoted by

be denoted by  . Then the

(Cornish-Fisher) asymptotic expansion (with respect to

. Then the

(Cornish-Fisher) asymptotic expansion (with respect to  ) for

the value of

) for

the value of  such that

such that  is

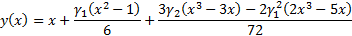

is  where:

where:

Here terms in brackets are terms of the same order with

respect to  ,

,  is

the mean of the distribution,

is

the mean of the distribution,  the standard deviation

of the distribution and

the standard deviation

of the distribution and  are the distribution’s

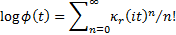

cumulants, i.e. the coefficients of the following power series expansion

for

are the distribution’s

cumulants, i.e. the coefficients of the following power series expansion

for  where

where  is the distribution’s characteristic

function.

is the distribution’s characteristic

function.

The cumulants are related to the moments of the distribution

via the relationship  (for

(for  )

where

)

where  is the skew(ness),

is the skew(ness),  is the (excess)

kurtosis etc.

is the (excess)

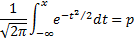

kurtosis etc.  is the relevant

cumulative Normal distribution point, i.e. the value for which:

is the relevant

cumulative Normal distribution point, i.e. the value for which:

and

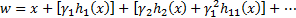

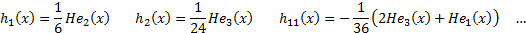

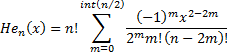

The  are the Hermite

polynomials, i.e.:

are the Hermite

polynomials, i.e.:

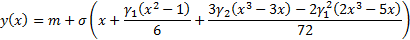

In effect, if we are using a fourth moment Cornish-Fisher

adjustment then this means estimating the shape of a quantile-quantile plot by

the following cubic, where  is the skew and

is the skew and  is the kurtosis of

the distribution:

is the kurtosis of

the distribution:

For standardised returns (with  and

and

), this simplifies to:

), this simplifies to: