Copulas – A short introduction

[this page | pdf | references | back links]

Copulas have become a more common risk management tool in

recent years because they provide a more complete means of characterising

co-dependency between series than merely correlation coefficients.

If different return series are coming from a multivariate

Normal distribution then their co-dependency characteristics are entirely

driven by their correlation matrix. A correlation coefficient of 1 corresponds

to perfectly positively correlated, 0 to be being uncorrelated and -1 to

completely negatively correlated). Whilst correlation is an important tool in

finance, correlation is not the same thing as ‘dependence’. Two series can on

average be ‘uncorrelated’ (across the distribution as a whole), but may still

be ‘correlated’ in the tail of the distribution (i.e. tend there to move in

tandem).

For risk management purposes we are often particularly

interested in extreme adverse events. In a portfolio context these will often

involve several very adverse factors coming together at the same time, i.e. we

are particularly interested in the extent to which factors driving portfolio

behaviour seem to be ‘correlated in the (downside) tail’ of the distribution.

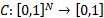

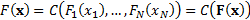

The definition of a copula is a function  where:

where:

(a) There are

(uniform) random variables  taking

values in

taking

values in  such

that

such

that  is

their cumulative (multivariate) distribution function; and

is

their cumulative (multivariate) distribution function; and

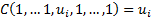

(b)  has uniform

marginal distributions, i.e. for all

has uniform

marginal distributions, i.e. for all  and

and  we

have

we

have

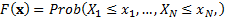

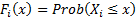

The basic rationale for copulas is that any joint

distribution  of a set of random variables

of a set of random variables  i.e.

i.e.

can

be separated into two parts. The first is the combination of the marginal

distribution functions for each random variable in isolation, also called the marginals, i.e.

can

be separated into two parts. The first is the combination of the marginal

distribution functions for each random variable in isolation, also called the marginals, i.e.  where

where

.

The second is the copula that describes the dependence structure between

the random variables. Mathematically, this decomposition relies on Sklar’s

theorem, which states that if

.

The second is the copula that describes the dependence structure between

the random variables. Mathematically, this decomposition relies on Sklar’s

theorem, which states that if  are

random variables with marginal distribution functions

are

random variables with marginal distribution functions  and

joint distribution function

and

joint distribution function  then there exists an N-dimensional

copula

then there exists an N-dimensional

copula  such that for all

such that for all  :

:

Copulas can be of any dimension  . For example,

the co-depency between 3 different series cannot be encapsulated merely by 3

different elements characterising the co-dependency between each pair of

series. A quantum mechanical analogue would be the possibility that 3 different

quantum mechanical objects can be ‘entangled’ in more complex ways than is

possible merely by considering each pair in turn.

. For example,

the co-depency between 3 different series cannot be encapsulated merely by 3

different elements characterising the co-dependency between each pair of

series. A quantum mechanical analogue would be the possibility that 3 different

quantum mechanical objects can be ‘entangled’ in more complex ways than is

possible merely by considering each pair in turn.

The simplest copulas are two-dimensional ones that

describe aspects of the co-depencency merely between two different

random variables. These are prototypical of more complicated copulas. Such a

copula,  , has the following properties:

, has the following properties:

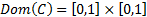

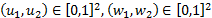

(a) Its domain,  ,

i.e. the range of values for which it is defined, is a unit square, i.e.

,

i.e. the range of values for which it is defined, is a unit square, i.e.

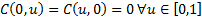

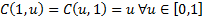

(b) It adheres to

the following relationships:

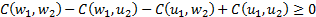

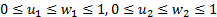

(c) It is ‘2-increasing’,

i.e.  whenever

whenever

and

and

The copula function of random variables is invariant under a

strictly increasing transformation. Thus the copula completely encapsulates the

dependence characteristics between different random variables.

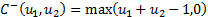

Certain relationships and limits can be derived on the

values that copulas can take. Fréchet copulas corresponding to the lower and

upper bounds  and

and

are:

are:

Any two-dimensional copula,  , satisfies the

following ordering, which is called the concordance order (for distributions)

or the stochastic order (for random variables)

, satisfies the

following ordering, which is called the concordance order (for distributions)

or the stochastic order (for random variables)

Another important special case is the product (or independence)

copula, see which is  .

.

Two random variables,  are

said to be:

are

said to be:

(a) countermonotonic

if

(b) independent

if

(c) comonotonic

if

Information on several of the above copulas (and on other

probability distributions) is available here,

including details of the following copulas: Clayton, Comonotonicity, Countermonotonicity,

Frank, Generalised

Clayton, Gumbel, Gaussian, Independence and t copulas.