Formulae for prices and Greeks for

European binary puts in a Black-Scholes world

[this page | pdf | references | back links]

See Black Scholes Greeks

for notation.

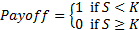

Payoff, see MnBSBinaryPutPayoff

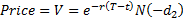

Price (value), see MnBSBinaryPutPrice

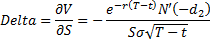

Delta (sensitivity to underlying), see MnBSBinaryPutDelta

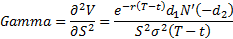

Gamma (sensitivity of delta to underlying), see MnBSBinaryPutGamma

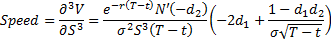

Speed (sensitivity of gamma to underlying), see MnBSBinaryPutSpeed

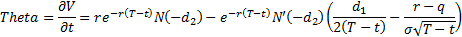

Theta (sensitivity to time), see MnBSBinaryPutTheta

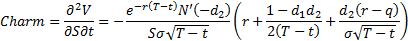

Charm (sensitivity of delta to time), see MnBSBinaryPutCharm

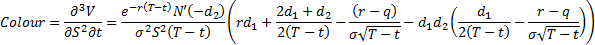

Colour (sensitivity of gamma to time), see MnBSBinaryPutColour

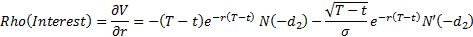

Rho(interest) (sensitivity to interest rate), see MnBSBinaryPutRhoInterest

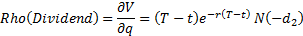

Rho(dividend) (sensitivity to dividend yield), see MnBSBinaryPutRhoDividend

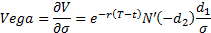

Vega (sensitivity to volatility), see MnBSBinaryPutVega*

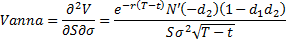

Vanna (sensitivity of delta to volatility), see MnBSBinaryPutVanna*

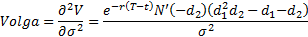

Volga (or Vomma) (sensitivity of vega to volatility), see MnBSBinaryPutVolga*

* Greeks like vega, vanna and Volga/vomma that involve

partial differentials with respect to  are in some sense

‘invalid’ in the context of Black-Scholes, since in its derivation we assume

that

are in some sense

‘invalid’ in the context of Black-Scholes, since in its derivation we assume

that  is constant. We

might interpret them as applying to a model in which

is constant. We

might interpret them as applying to a model in which  was

slightly variable but otherwise was close to constant for all

was

slightly variable but otherwise was close to constant for all  ,

,

etc.. Vega, for

example, would then measure the sensitivity to changes in the mean level of

etc.. Vega, for

example, would then measure the sensitivity to changes in the mean level of  .

For some types of derivatives, e.g. binary puts and calls, it can be difficult

to interpret how these particular sensitivities should be understood.

.

For some types of derivatives, e.g. binary puts and calls, it can be difficult

to interpret how these particular sensitivities should be understood.