Deriving the Black-Scholes Option Pricing

Formulae using the limit of a suitably constructed lattice

[this page | pdf | references | back links]

Suppose we knew for certain that between time  and

and

the price of the

underlying could move from

the price of the

underlying could move from  to either

to either  or

to

or

to  , where

, where  (as in the diagram

below), that cash (or more precisely the appropriate risk-free asset) invested

over that period earns an interest rate (continuously compounded) of

(as in the diagram

below), that cash (or more precisely the appropriate risk-free asset) invested

over that period earns an interest rate (continuously compounded) of  and

that the underlying (here assumed to be an equity or an equity index) generates

income, i.e. dividend yield, (continuously compounded) of

and

that the underlying (here assumed to be an equity or an equity index) generates

income, i.e. dividend yield, (continuously compounded) of  .

.

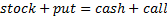

Diagram illustrating single time-step binomial option

pricing

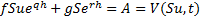

Suppose that we also have a derivative (or indeed any other

sort of security) which (at time  ) is worth

) is worth  if the share price has

moved to

if the share price has

moved to  , and worth

, and worth  if it has moved to

if it has moved to  .

.

Starting at  at time

at time  , we

can (in the absence of transaction costs and in an arbitrage-free world)

construct a hedge portfolio at time

, we

can (in the absence of transaction costs and in an arbitrage-free world)

construct a hedge portfolio at time  that is guaranteed to

have the same value as the derivative at time

that is guaranteed to

have the same value as the derivative at time  whichever

outcome materialises. We do this by investing (at time

whichever

outcome materialises. We do this by investing (at time  )

)  in

in  units

of the underlying and investing

units

of the underlying and investing  in the risk-free

security, where

in the risk-free

security, where  and

and  satisfy

the following two simultaneous equations:

satisfy

the following two simultaneous equations:

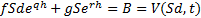

Hence:

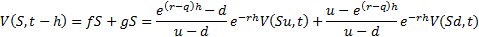

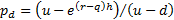

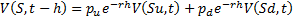

The value of the hedge portfolio and hence, by the principle

of no arbitrage, the value of the derivative at time  can

thus be derived by the following backward equation:

can

thus be derived by the following backward equation:

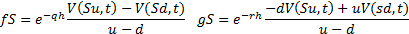

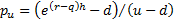

We can rewrite this equation as follows, where  and

and  and hence

and hence  .

.

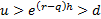

Assuming that the two potential movements are chosen so that

and

and  are both positive,

i.e. with

are both positive,

i.e. with  then

then  and

and  correspond to the

relevant risk neutral probabilities for the lattice element. Getting

correspond to the

relevant risk neutral probabilities for the lattice element. Getting  and

and  to adhere to this

constraint is not normally difficult for an option like this since

to adhere to this

constraint is not normally difficult for an option like this since  is the forward price

of the security and it would be an odd sort of binomial tree that did not

straddle the expected movement in the underlying.

is the forward price

of the security and it would be an odd sort of binomial tree that did not

straddle the expected movement in the underlying.

In the multi-period analogue, the price of the underlying is

assumed to be able to move in the first period either up or down by a factor  or

or  , and

in second and subsequent periods up or down by a further

, and

in second and subsequent periods up or down by a further  or

or  from

where it had reached at the end of the preceding period.

from

where it had reached at the end of the preceding period.  or

or  can

in principle vary depending on the time period (e.g.

can

in principle vary depending on the time period (e.g.  might

be size

might

be size  in time step

in time step  ,

etc.) but it would then be usual to require the lattice to be recombining. In such a lattice an up movement in one time period followed by a down

movement in the next leaves the price of the underlying at the same value as a

down followed by an up. It would also be common, but again not essential (and

sometimes inappropriate), to have each time period of the same length,

,

etc.) but it would then be usual to require the lattice to be recombining. In such a lattice an up movement in one time period followed by a down

movement in the next leaves the price of the underlying at the same value as a

down followed by an up. It would also be common, but again not essential (and

sometimes inappropriate), to have each time period of the same length,  .

.

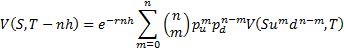

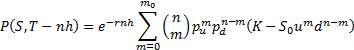

By repeated application of the backward equation referred to

above, we can derive the price  periods back, i.e. at

periods back, i.e. at  , of a derivative with

an arbitrary payoff at time

, of a derivative with

an arbitrary payoff at time  . If

. If  ,

,  ,

,  ,

,  ,

,  and

and  are

the same for each period then:

are

the same for each period then:

where:

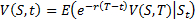

This can be re-expressed as an expectation under a risk-neutral probability distribution, i.e. in the following form, where  means the expected

value of

means the expected

value of  given the risk neutral

measure, conditional on being in state

given the risk neutral

measure, conditional on being in state  when the expectation

is carried out:

when the expectation

is carried out:

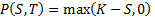

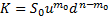

Suppose we have a European-style put option with strike

price  (assumed to be at a

node of the lattice) maturing at time

(assumed to be at a

node of the lattice) maturing at time  and we want to

identify its price,

and we want to

identify its price,  prior to maturity,

i.e. where

prior to maturity,

i.e. where  . Suppose also that

. Suppose also that  and

and  are

the same for each time period. The price of the option at maturity is given by

its payoff, i.e.

are

the same for each time period. The price of the option at maturity is given by

its payoff, i.e.  where

where  say for some

say for some  (here

(here  is the price ruling at

time

is the price ruling at

time  used to construct the

first node in the lattice). Applying the multi-period pricing formula set out

above, we find that the price of such an option at time

used to construct the

first node in the lattice). Applying the multi-period pricing formula set out

above, we find that the price of such an option at time  in such a framework is

as follows, where

in such a framework is

as follows, where  is the binomial

probability distribution function, i.e.

is the binomial

probability distribution function, i.e.  , bearing in mind that

, bearing in mind that  :

:

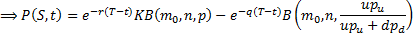

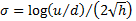

Suppose we define the volatility of the lattice to be

and suppose too that

this is constant, i.e. the same for each time period. Then if we allow

and suppose too that

this is constant, i.e. the same for each time period. Then if we allow  to

tend to zero, keeping

to

tend to zero, keeping  ,

,  ,

,  etc.

fixed, with

etc.

fixed, with  by, say, setting

by, say, setting  and

and  , we find that the

above formula and hence the price of the put option tends to:

, we find that the

above formula and hence the price of the put option tends to:

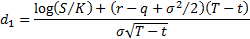

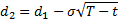

where

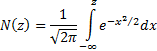

and  is the cumulative

Normal distribution function, i.e.

is the cumulative

Normal distribution function, i.e.

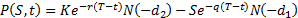

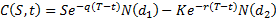

The corresponding formula (in the limit) for the price,  of a European call

option maturing at time

of a European call

option maturing at time  with a strike price of

with a strike price of

can be derived in an

equivalent manner as:

can be derived in an

equivalent manner as:

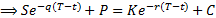

This formula can also be justified on the grounds that the

value of a combination of a European put option and a European call option with

the same strike price should satisfy so-called put-call parity,

if they are to satisfy the principle of no arbitrage, i.e. (after allowing for

dividends and interest):

Strictly speaking, these formulae for European put and call

options are the Garman-Kohlhagen formulae for

dividend bearing securities and only if  is set to zero do they

become the original Black-Scholes option pricing formulae, although in

practice most people would actually refer to these formulae as the Black-Scholes

formulae, and call a world satisfying the assumptions underlying these formulae

as a ‘Black-Scholes’ world. The volatility

is set to zero do they

become the original Black-Scholes option pricing formulae, although in

practice most people would actually refer to these formulae as the Black-Scholes

formulae, and call a world satisfying the assumptions underlying these formulae

as a ‘Black-Scholes’ world. The volatility  used in their

derivation has a natural correspondence with the volatility that the share

price might be expected to exhibit in a Black-Scholes world.

used in their

derivation has a natural correspondence with the volatility that the share

price might be expected to exhibit in a Black-Scholes world.