Testing Investment Manager Skill

[this page | pdf | back links]

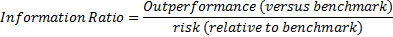

Because investment management involves seeking an

appropriate balance between risk and reward, assessment of manager skill

generally focuses on measures that takes due account of both of these factors.

The most common statistic used, at least for managers who

have an outperformance target relative to a benchmark is thus the Information

Ratio, which is calculated as:

Here, outperformance is relative return (possibly annualised,

and possibly also converted into geometric or

logarithmic form). Risk is measured by reference to standard deviation of

relative return.

The corresponding statistic, if the benchmark is cash (or an

absolute performance objective) is the Sharpe ratio, see Risk Measurement

Glossary.

Effectively, the Information Ratio is measuring the

outperformance per unit of risk taken (i.e. ‘bangs per buck’). If all relative

positions were doubled in size (and assuming that the investor only holds a

small proportion of the total of such exposures, so such a doubling does not in

practice increase the investor’s liquidity risk), then outperformance and risk,

as measured above, should both double and hence the Information Ratio should

remain unaltered. So the Information Ratio measures the skill at selecting and

implementing investment ideas as it is invariant to the amount of capital put

to work with these ideas.

The use of standard deviations to measure risk implicitly

assumes that returns are not fat-tailed or that the investor is indifferent to

fat-tailed behaviour to the extent that it does exist. Either the Information

Ratio or the Sharpe ratio can be refined to use other measures of risk deemed

more appropriate by the investor, e.g. downside risk (see Sortino ratio in Risk Measurement

Glossary) or measures that give greater importance to fat-tailed behaviour,

akin to those used for independent

components analysis.

If returns are log-normally distributed then the information

ratio (if outperformance and risk are both expressed logarithmically) is the

same as the t-statistic that would be used to test for the mean of the

distribution being significantly different from zero.

If we further assume that investment manager ‘skill’ is

relatively rare (an assumption that seems to be approximately true for many

asset types) then we should expect the spread of Information Ratios that a

selection of active managers (e.g. a peer group of funds all investing in the

same asset class) to be distributed in the same way as the corresponding t-statistic

would be distributed under the null hypothesis that the mean (relative) return

is zero. Such a methodology can be used to estimate the information ratio level

needed to be, say, upper quartile in such a peer group. For large  , where

, where  is the

number of funds in the peer group, the distribution tends to a normal

distribution independent of

is the

number of funds in the peer group, the distribution tends to a normal

distribution independent of  and hence independent of

the peer group in question.

and hence independent of

the peer group in question.

If we make further assumptions about the typical spread of

risk that different managers in a given peer group might exhibit, we can derive

approximations for the level of risk that a manager needs to take to achieve an

upper quartile performance given a specific level of skill. For many peer

groups an approximately median level of risk coupled with an upper quartile

information ratio appears to equate to approximately an upper quartile

performance.