Performance Measurement Theory

2. Mathematics of multi-period analysis

[this page | pdf | references | back links]

Return to

Abstract and Contents

Next page

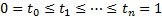

2.1 Suppose that we are interested in calculating

the rate of return on a portfolio from time 0 to time 1 using some suitable

units of time. Suppose that there are n new money payments into or out

of the portfolio in the period of value  (positive for

inflows, negative for outflows) occurring at times

(positive for

inflows, negative for outflows) occurring at times  for

for  .

The

.

The  are assumed to

be ordered so that

are assumed to

be ordered so that  . The market

values at the corresponding points in time (immediately after receipt of the

new money) are

. The market

values at the corresponding points in time (immediately after receipt of the

new money) are  .

Dividend/interest payments are treated as outflows from the relevant stock/bond

sector and inflows into the cash sector, and so net to zero at the total fund

level (unless the income is paid away).

.

Dividend/interest payments are treated as outflows from the relevant stock/bond

sector and inflows into the cash sector, and so net to zero at the total fund

level (unless the income is paid away).

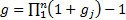

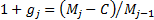

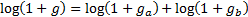

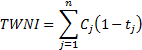

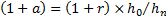

2.2 The time-weighted rate of return for the

period is then  where

where  . The

time-weighted rate of return is effectively equivalent to the growth in a unit

net asset value price (were the fund to be unitised and were it to accumulate

income internally, ignoring complications such as bid/offer spreads, etc.) The

positive or negative impact of money arriving or being withdrawn from the

portfolio at opportune or inopportune times is stripped out of the calculation.

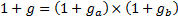

Time-weighted rates of return naturally compound up over time, i.e. if the

time-weighted rate of return in one period is

. The

time-weighted rate of return is effectively equivalent to the growth in a unit

net asset value price (were the fund to be unitised and were it to accumulate

income internally, ignoring complications such as bid/offer spreads, etc.) The

positive or negative impact of money arriving or being withdrawn from the

portfolio at opportune or inopportune times is stripped out of the calculation.

Time-weighted rates of return naturally compound up over time, i.e. if the

time-weighted rate of return in one period is  and in the next

is

and in the next

is  then the time

weighted rate of return for the combined period is

then the time

weighted rate of return for the combined period is  where

where

. This also means

that ‘logged’ returns, i.e.

. This also means

that ‘logged’ returns, i.e.  , naturally add

up through time, i.e.

, naturally add

up through time, i.e.  .

.

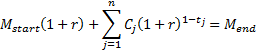

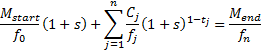

2.3 The money-weighted or internal rate of

return on a fund over the same period, is defined as the ‘sensible’

solution for  to the following

equation (if the

to the following

equation (if the  are of differing

signs then there will usually be more than one solution, although normally only

one would be intrinsically ‘sensible’):

are of differing

signs then there will usually be more than one solution, although normally only

one would be intrinsically ‘sensible’):

2.4 The time-weighted rate of return and the

money-weighted rate of return are thus the same if there have been no cash

flows during the period.

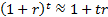

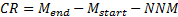

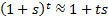

2.5 One nearly always assumes that  . The internal

rate of return can therefore be approximated by the formula

. The internal

rate of return can therefore be approximated by the formula  , where the contribution

to return (

, where the contribution

to return ( ), net new

money (

), net new

money ( ), time-weighted

net investment (

), time-weighted

net investment ( ), and mean

fund (

), and mean

fund ( ), are defined as

follows:

), are defined as

follows:

2.6 The internal rate of return is the (constant)

interest rate that a bank account would need to provide (possibly negative) to

return the same amount at the end of the period as the portfolio, given the

same new money flows and the same start market value. It is therefore the same

as the money-weighted rate of return and so again does not naturally compound

up over time.

2.7 Calculating the time-weighted rate of return in

principle involves valuations whenever there is a cash flow. This can be time

consuming, unless you have an exceptionally good valuation engine (and even

then is potentially impossible if you wish to value at the exact intra-day

point of time at which a particular trade takes place).

2.8 In practice, therefore, performance measurers

often merely chain-link internal rates of return. This is because the money

weighted and time weighted rates of return are the same if there are no

intra-period new money flows. So, if you calculate internal rates of return

sufficiently often and chain-link them together then the result will always

tend to the time-weighted rate of return.

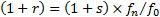

In certain other special circumstances, the money-weighted

and time-weighted rates of return are also identical. Normally, cash flows and

market values will be expressed in some base currency, but suppose we

generalise the calculation of money-weighted rates of return so that it can

include an arbitrary calculation numeraire, which is worth  in the base

currency at time

in the base

currency at time  The money-weighted

rate of return then becomes

The money-weighted

rate of return then becomes  where

where  and where

and where  is

the solution to:

is

the solution to:

2.9 The money-weighted rate of return described

above is then merely a special case of this calculation with a constant (in

base currency) numeraire. Suppose that we choose  , where

, where  corresponds to

the true cumulative time-weighted return from time 0 to time

corresponds to

the true cumulative time-weighted return from time 0 to time  Then

Then  and

the money-weighted rate of return,

and

the money-weighted rate of return,  , will (in this

numeraire) be identical to the time-weighted rate of return

, will (in this

numeraire) be identical to the time-weighted rate of return  .

If

.

If  closely

approximates to

closely

approximates to  then

then  will

closely approximate to 0, and the approximation

will

closely approximate to 0, and the approximation  will be very

good. The money-weighted rate of return using such a numeraire will then be

very similar to the true time-weighted rate of return. If the new money flows

are small in relation to start and end market values then the

money-weighted rate of return will also be very similar to the true

time-weighted rate of return, irrespective of the calculation numeraire.

will be very

good. The money-weighted rate of return using such a numeraire will then be

very similar to the true time-weighted rate of return. If the new money flows

are small in relation to start and end market values then the

money-weighted rate of return will also be very similar to the true

time-weighted rate of return, irrespective of the calculation numeraire.

2.10 The calculation numeraire can be differentiated

from the presentation numeraire used to express the results of the

calculation, which will normally be the base currency of the portfolio. If the

presentation numeraire is  then the rates

of return would be restated to be

then the rates

of return would be restated to be  where

where  .

.

2.11 The above approach requires not only fund

holding and valuation price data but also information on the prices at which

individual transactions were carried out. If these are difficult to obtain then

an alternative, less exact, methodology involves buy and hold

attribution. In this methodology, the return on each line of stock is imputed

merely from market data over a given period (usually daily) on the assumption

that no transactions have taken place. Such an approach produces the same

answer as a true transactions-based analysis either if no transactions occur or

if they occur at the prices assumed in the algorithm. Unfortunately this

approximation can lead to significant residuals for funds with high turnover or

subject to significant dealing costs.

NAVIGATION LINKS

Contents | Prev | Next