Derivative Pricing Theory: Optimising a

trinomial lattice to converge more rapidly than a binomial lattice

[this page | pdf | references | back links]

In a situation where  ,

,  and

and

are constant

through time, a trinomial lattice framework that seems to provide effective

enhancements in convergence properties is as set out in Kemp (1997).

Suppose

are constant

through time, a trinomial lattice framework that seems to provide effective

enhancements in convergence properties is as set out in Kemp (1997).

Suppose  characterises the

lattice point in which we have had

characterises the

lattice point in which we have had  time steps from

outset and we are

time steps from

outset and we are  steps above the

lowest possible that is included in the trinomial tree. We propose a lattice

calculated as follows. Movement should be allowed from

steps above the

lowest possible that is included in the trinomial tree. We propose a lattice

calculated as follows. Movement should be allowed from  to

to  (i.e. up,

(i.e. up,  ),

),

(sideways,

(sideways,  )

or

)

or  (down,

(down,  ),

with the nodes of the lattice defined by

),

with the nodes of the lattice defined by  for some

for some  and

and

defined as below.

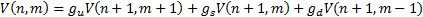

The backwards equation is then defined as follows:

defined as below.

The backwards equation is then defined as follows:

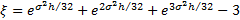

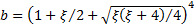

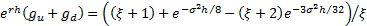

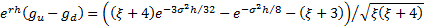

where:  ,

,  ,

,  ,

,  ,

,  ,

,  and additionally

and additionally  ,

,  and

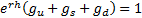

and  are chosen so that

the following three simultaneous equations are satisfied:

are chosen so that

the following three simultaneous equations are satisfied:

Such a lattice is

designed so that if we were to price a derivative paying  for each of

for each of  , then the lattice would

give exactly the right answer. For standard types of European and American

options this calibrated trinomial lattice can converge much more rapidly than

the equivalent binomial lattice. If

, then the lattice would

give exactly the right answer. For standard types of European and American

options this calibrated trinomial lattice can converge much more rapidly than

the equivalent binomial lattice. If  ,

,  and

and

change through time

(in a deterministic way) then corresponding lattices (including risk-neutral

lattice migration probabilities) can be derived in an analogous fashion with

the same end goal, but the formulae involved will be time-varying and therefore

more complicated.

change through time

(in a deterministic way) then corresponding lattices (including risk-neutral

lattice migration probabilities) can be derived in an analogous fashion with

the same end goal, but the formulae involved will be time-varying and therefore

more complicated.

The complexity of the

above highlights an important practical aspect of derivative pricing. Whilst

the principles are in some sense conceptually relatively easy to grasp, the

mathematics can get complicated very quickly as soon as you start trying to

apply the concepts in practice, particularly if you want to do so in ways that

are relatively efficient to compute. It is not always clear how complex it

might be best to get in such a quest. For example:

(a) We might expect

to be able to improve convergence still further by using quadrinomial or even

more complicated lattices, but the effort involved in programming them becomes

progressively more complicated, and it becomes less easy to ensure that the

optimal lattice structure is recombining, so for fast numerical computation of

options using lattices, trinomial lattices are likely to be preferred over more

complex lattices in most circumstances.

(b) There are actually two

main sorts of errors arising with lattice pricing methods. The first sort of

error relates to propagation errors via the backwards equation, which can be

much reduced by using trinomial lattices rather than binomial ones. The second

sort of error involves the approximation of a continuous pay-off at maturity

with one involving discrete amounts at each maturity node. It can be reduced

by setting the pay-off at each maturity node equal to the average of maturity

pay-off for prices of the underlying closest to the node. This second sort of

error is not improved merely by use of a trinomial lattice. Typically better

still is to use semi-analytic lattice integrator approaches, see e.g. Hu, Kerkhof,

McCloud and Wackertapp (2007) or Semi-analytic

lattice integrator approaches, if the payoff function can be approximated

by piecewise polynomials and the risk-neutral probability distribution is

analytically tractable.

(c) Other ways exist

of improving convergence of binomial lattices not (directly) involving

trinomial lattices or the like. Because the pricing formulae can be rewritten

as expectations (under the risk neutral probability distribution) and because

expectations are merely specific instances of the mathematical process of

integration, lattices can be thought of as approximate ways of carrying out

integration. Various mathematical tools and techniques exist that can be

applied to this task, see e.g. Press et

al. (2007). Some of these tools appear to be as good as if not better

than using trinomial lattices (and even if they are not actually better they

may be rather simpler to understand and program reliably).

See also MnOptimisedTrinomialLatticeProbs.