CCCall

[this page | pdf | references | back links]

Function Description

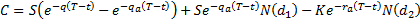

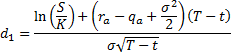

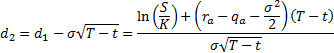

Returns the price, C, of a European-style call option

under the ‘Cost

of Capital’ Pricing Model, i.e.:

where

NAVIGATION LINKS

Contents | Prev | Next

Output type / Parameter details

Output type: Double

| Parameter Name | Variable Type | Description |

| StrikePrice | Double | Strike price of option |

| UnderlyingPrice | Double | Current price of underlying |

| InterestCts | Double | Interest rate (continously compounded) |

| DividendCts | Double | Dividend yield (continuously compounded) |

| TimeNow | Double | Time now (typically 0) |

| TimeMaturity | Double | Time at maturity |

| ImpliedVolatility | Double | Implied volatility (of price of underlying) |

| JumpInterestCts | Double | Interest rate (continously compounded) required to recompense writer against fall to zero in underlying |

| JumpDividendCts | Double | Dividend yield (continuously compounded) required to recompense writer against jump to infinity in underlying |

Links to:

-

Interactively run function

-

Interactive instructions

-

Example calculation

-

Output type / Parameter details

-

Illustrative spreadsheet

-

Other Derivative pricing functions

-

Computation units used

Note: If you use any Nematrian web service either programmatically or interactively then you will be deemed to have agreed to the Nematrian website License Agreement