BSCall

[this page | pdf | references | back links]

Function Description

Returns the price  of a European call option assuming

that the (generalised) Black-Scholes (i.e. Garman-Kohlhagen) pricing formula

applies.

of a European call option assuming

that the (generalised) Black-Scholes (i.e. Garman-Kohlhagen) pricing formula

applies.

If the current price of the underlying is  , the strike (i.e.

exercise) price of the option is

, the strike (i.e.

exercise) price of the option is  , the continuously compounded rate of

interest is

, the continuously compounded rate of

interest is  , the continuously compounded annualised

dividend yield (assumed continuous not discrete) is

, the continuously compounded annualised

dividend yield (assumed continuous not discrete) is  , time now (in

years) is

, time now (in

years) is  , time at expiry is

, time at expiry is  and the (annualised)

implied volatility is

and the (annualised)

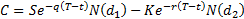

implied volatility is  then the price of such an option is

given by:

then the price of such an option is

given by:

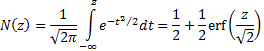

where  is

the cumulative unit normal distribution function (see MnCumulativeNormal),

i.e.

is

the cumulative unit normal distribution function (see MnCumulativeNormal),

i.e.

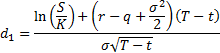

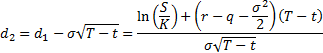

and

NAVIGATION LINKS

Contents | Prev | Next

Links to:

-

Interactively run function

-

Interactive instructions

-

Example calculation

-

Output type / Parameter details

-

Illustrative spreadsheet

-

Other Derivative pricing functions

-

Computation units used

Note: If you use any Nematrian web service either programmatically or interactively then you will be deemed to have agreed to the Nematrian website License Agreement