Errata for Malcolm Kemp’s ExtremeEvents:

Robust Portfolio Construction in the Presence of Fat Tails, published by

Wileys

[this page | pdf | references | back links]

In paragraph (a) on page 34, after the words “then the

Central Limit Theorem implies that over this short time interval the return

should be approximately Normal” there should be a footnote saying:

“To be more precise, we are here envisaging a situation

where we have, say,  ‘similar’ contributory

factors (each with finite variance) and as

‘similar’ contributory

factors (each with finite variance) and as  we

give less and less weight to each individual factor but have more and more of

them. If instead the contributory factors become more and more non-Normal as

we

give less and less weight to each individual factor but have more and more of

them. If instead the contributory factors become more and more non-Normal as  (i.e.

do not stay ‘similar’ as

(i.e.

do not stay ‘similar’ as  ) then the CLT may break

down, see Kemp (2010).”

) then the CLT may break

down, see Kemp (2010).”

A counter-example, if the distributional form of the

individual factors changes as  increases, which is what

“Kemp (2010)” here refers, to is given in Extreme Events Errata

(1).

increases, which is what

“Kemp (2010)” here refers, to is given in Extreme Events Errata

(1).

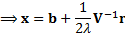

On page 171 Equation 5.25 should read:

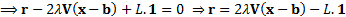

And Equation 5.26 should read:

On page 171 Equation 5.25 should read: