Estimating operational risk capital

requirements assuming data follows a gamma distribution (using the method of

moments)

[this page | pdf | back links]

Suppose a firm has collated past operational annual loss

data and the distribution of these annual losses is expected to provide a good

guide to the distribution of future annual losses. Suppose the annual losses

are  .

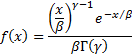

Suppose also that the losses come from a gamma distribution with probability

density function:

.

Suppose also that the losses come from a gamma distribution with probability

density function:

where  is

a scale parameter (

is

a scale parameter ( )

and

)

and  is

a shape parameter (

is

a shape parameter ( ).

).

One way of estimating  and

and

is

to use the ‘method of moments’ which for the gamma distribution can be done

analytically.

is

to use the ‘method of moments’ which for the gamma distribution can be done

analytically.

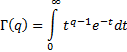

We note that the gamma function  is

defined as:

is

defined as:

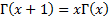

This means that it has the property that  for

for

.

It also means (for

.

It also means (for  and

and

)

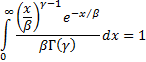

that the following is true (which is necessary for the probability density of

the gamma distribution to integrate to unity):

)

that the following is true (which is necessary for the probability density of

the gamma distribution to integrate to unity):

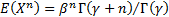

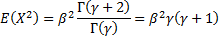

We next note that the gamma distribution has the property

that  .

This is because:

.

This is because:

To use the method of moments we will calculate the first  moments

of the observed data where

moments

of the observed data where  is

the number of parameters to estimate. The gamma distribution has two parameters

so here we have

is

the number of parameters to estimate. The gamma distribution has two parameters

so here we have  and

in this instance we calculate the first two moments (or equivalently the mean

and variance) of the observed data and also the same two moments if the data

comes from a gamma distribution with parameters

and

in this instance we calculate the first two moments (or equivalently the mean

and variance) of the observed data and also the same two moments if the data

comes from a gamma distribution with parameters  and

and

respectively.

We then select values of

respectively.

We then select values of  and

and

that

simultaneously equate the observed moments with the distributional moments.

that

simultaneously equate the observed moments with the distributional moments.

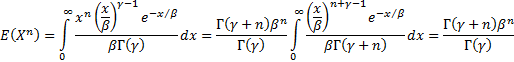

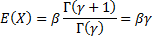

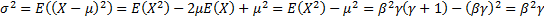

For the gamma distribution we have:

So the mean  and

the variance

and

the variance  .

.

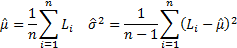

The observed (sample) mean and variance [note it is not

absolutely clear with method of moments whether to use the sample or population variance]

are:

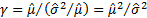

So, with the method of moments we would select  and

and

so

that

so

that  ,

,

,

i.e.

,

i.e.  and

and

.

.

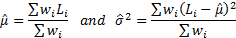

If more recent observations were believed to be more

relevant than less recent observations then we could give greater weight to

more recent observations in the calculation of  and

and

,

e.g. if the weights were

,

e.g. if the weights were  then

we might use (if we were focusing on population moments):

then

we might use (if we were focusing on population moments):

[N.B. See here for

insights on how to calculate weighted sample moments]

Another common method of estimating parameter values is to

use maximum likelihood estimation, which cannot in general be done analytically

for the gamma distribution but can be done numerically using e.g. the Nematrian

website function MnProbDistMLE.

Of course, to estimate, say, a Value-at-Risk for

operational risk you would ideally not just rely on past annual operational

loss data. Additional information you might seek (and why you might seek it)

includes:

From within the firm

Ideally, it would be helpful to have individual losses (so

that you have amounts and frequency) allowing you to analyse loss size, i.e.

severity, and loss frequency separately. Also desirable would be losses

subdivided into appropriate categories, as this should provide extra colour on

the losses being suffered. It would ideally also be helpful to have ‘volume’ statistics

that are believed to be correlated with loss frequency. For example,

operational losses might be expected to be linked to number of customers, staff

turnover, funds under management etc. This sort of volume data should help you

to estimate future annual losses better and also to get a better understanding

of past behaviour.

From elsewhere

Hopefully the firm’s historic operational losses have been

relatively small and have also been infrequent. Its own historical data may not

therefore provide a good guide to the magnitude of large losses it might incur

in the future. Access to other firms’ experience, including e.g. data collected

by industry bodies, is therefore likely to be helpful, as long as the

industry-wide experience is expected to be relevant to the firm.