Estimating operational risk capital

requirements assuming data follows a bi-exponential distribution

[this page | pdf | back links]

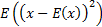

Suppose a risk manager believes that an appropriate model

for a particular type of operational risk exposure involves the loss,  ,

coming 50% of the time from an exponential

distribution with parameter

,

coming 50% of the time from an exponential

distribution with parameter  and

50% of the time come from an exponential distribution with parameter

and

50% of the time come from an exponential distribution with parameter  .

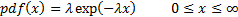

The exponential distribution

.

The exponential distribution  has

a probability density function,

has

a probability density function,  ,

mean,

,

mean,  ,

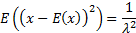

and variance

,

and variance  as

follows:

as

follows:

Suppose we want method of moments (MoM) estimators for  and

and

and

we have loss data

and

we have loss data  for

for

where

the number of losses,

where

the number of losses,  ,

is sufficiently large to be able to ignore small sample corrections. Then the

MoM estimators can be derived as follows, where the (sample) moments used in

the estimation are

,

is sufficiently large to be able to ignore small sample corrections. Then the

MoM estimators can be derived as follows, where the (sample) moments used in

the estimation are  and

and

.

.

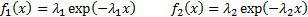

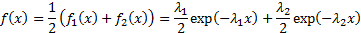

The pdfs of the individual parts,

,

and of the overall distribution,

,

and of the overall distribution,  ,

are:

,

are:

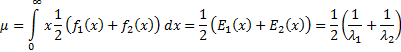

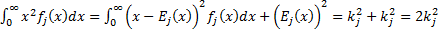

The mean of  is:

is:

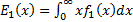

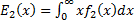

where  and

and

By integrating by parts or by noting that  for

for

where

where  and

and

,

we note that

,

we note that

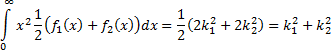

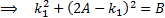

So method of moments estimators involve (if these

simultaneous equations have a (real) solution):

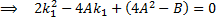

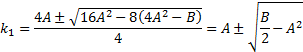

This is a quadratic equation which has the following

solutions:

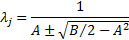

The two roots correspond to  and

and

(it

is not possible to differentiate between them given merely the data being

provided). Hence the values of

(it

is not possible to differentiate between them given merely the data being

provided). Hence the values of  and

and

are:

are:

In practice it is more likely that the probabilities of

drawing from the underlying exponentials are unknown. This adds an extra degree

of freedom which would introduce the need to include a further (higher) moment

into the parameter estimation process.