Enterprise Risk Management Formula Book

9. Risk measures

[this page | pdf | back links]

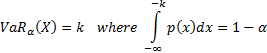

9.1 Value-at-Risk (VaR)

If  is a (continuous)

random variable (e.g. an outcome) with pdf

is a (continuous)

random variable (e.g. an outcome) with pdf  then the Value-at-Risk at

confidence level

then the Value-at-Risk at

confidence level  (e.g. 95%, 99%,

99.5%) is defined as:

(e.g. 95%, 99%,

99.5%) is defined as:

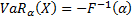

If  has cdf

has cdf  with an inverse

cdf, i.e. quantile function

with an inverse

cdf, i.e. quantile function  then

then  . Sometimes signs

are inverted and

. Sometimes signs

are inverted and  and

and  are

swapped around when defining

are

swapped around when defining  .

.

The relative VaR of  relative

relative

, e.g. of an active

equity portfolio versus a benchmark portfolio is usually taken to mean the VaR

of the random variable

, e.g. of an active

equity portfolio versus a benchmark portfolio is usually taken to mean the VaR

of the random variable  . However, for

relative returns there are several alternative ways in which we can define the

equivalent of

. However, for

relative returns there are several alternative ways in which we can define the

equivalent of  , see definition of

tracking error.

, see definition of

tracking error.

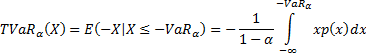

9.2 Tail Value-at-Risk (TVaR)

The Tail

Value-at-Risk (also called the conditional Value-at-Risk, CVaR) is

generally defined as the value of the loss conditional on it being worse than

the VaR at confidence level  , so is defined as:

, so is defined as:

A coherent risk measure is one that satisfies subadditivity,

monotonicity, homogeneity and translational invariance. If

losses follow a continuous probability distribution then TVAR is a coherent

risk measure.

Occasionally TVaR (less commonly CVaR) is ascribed the same

meaning as expected shortfall, in which case the  factor is ignored,

or is defined relative to some specific limit

factor is ignored,

or is defined relative to some specific limit  that

in effect defines the

that

in effect defines the  to be used in the

above formula.

to be used in the

above formula.

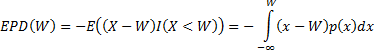

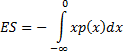

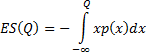

9.3 Expected shortfall (ES)

The expected

shortfall, ES, and expected policyholder deficit, EPD are usually defined

as follows:

Expected policyholder deficit:

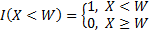

where  and

and  is

often but not always the policyholder wealth

is

often but not always the policyholder wealth

Expected shortfall:

Or more generally the expected shortfall below some trigger

level  is

is

Sometimes expected shortfall is ascribed the same meaning as

is given above for TVaR.

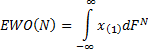

9.4 Expected worst outcome (EWO)

The expected value of the worst outcome in  (non-overlapping)

observations is:

(non-overlapping)

observations is:

where the integral is  -dimensional,

-dimensional,  and the joint

distribution

and the joint

distribution  involves

involves  independent

marginal distributions each with pdf

independent

marginal distributions each with pdf  . This type of risk

measure can also be extended to, say,

. This type of risk

measure can also be extended to, say,  ’th worst outcome,

’th worst outcome,  with

with

as defined above

being the special case where

as defined above

being the special case where  .

.

9.5 Tracking error (TE)

If  is a random

variable (e.g. a portfolio return) with (assumed forward looking) pdf

is a random

variable (e.g. a portfolio return) with (assumed forward looking) pdf  then its ex-ante

tracking error (if it exists) is

then its ex-ante

tracking error (if it exists) is  where

where

Nearly always  is here the

relative return of a portfolio

is here the

relative return of a portfolio  of exposures versus

a benchmark portfolio

of exposures versus

a benchmark portfolio  and the tracking

error is then normally expressed as a percentage of the total portfolio value.

The tracking error of

and the tracking

error is then normally expressed as a percentage of the total portfolio value.

The tracking error of  versus

versus  is then

is then  (more precisely,

(more precisely,  for a time period

indexed by

for a time period

indexed by  ) where if the

future returns on the

) where if the

future returns on the  ’th instrument

during this are

’th instrument

during this are  and relative

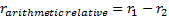

returns are calculated arithmetically (i.e. using an arithmetic difference):

and relative

returns are calculated arithmetically (i.e. using an arithmetic difference):

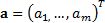

where  is the vector of

active positions.

is the vector of

active positions.

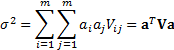

If the  have covariance

matrix

have covariance

matrix  with elements

with elements  then

then  .

.

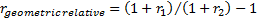

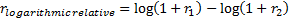

However, returns compound rather than add through time so

for non-infinitesimal time period lengths there are alternative and potentially

preferable ways of defining relative returns, including (if we are trying to

calculate the return  relative to

relative to  , each expressed as

fractions) using geometric relative returns, i.e.

, each expressed as

fractions) using geometric relative returns, i.e.  , or logarithmic

relative returns, i.e.

, or logarithmic

relative returns, i.e.  rather than

arithmetic relative returns

rather than

arithmetic relative returns  .

.

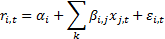

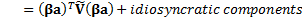

If a factor structure is assumed for the  then this normally

involves assuming that:

then this normally

involves assuming that:

where  is the exposure

(beta) of the

is the exposure

(beta) of the  ’th instrument to

the

’th instrument to

the  ’th factor and

’th factor and  are residual

(idiosyncratic) components.

are residual

(idiosyncratic) components.

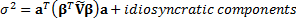

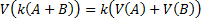

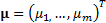

A portfolio described by a vector of (active) weights  then has an

expected return of

then has an

expected return of  and an (expected)

future tracking error as follows, where

and an (expected)

future tracking error as follows, where  is the matrix

formed by

is the matrix

formed by  and

and  is the covariance

matrix between the factors

is the covariance

matrix between the factors

If  is the length of

time (time horizon) to which the ex-ante tracking error relates and returns in

individual time periods of length

is the length of

time (time horizon) to which the ex-ante tracking error relates and returns in

individual time periods of length  are assumed to be

independent of each other then (assuming e.g. we measure returns

logarithmically and that the portfolio and benchmark remain unchanged through

time) we can apply the square-root of time adjustment to derive ex ante

tracking errors applicable to different time periods, i.e.:

are assumed to be

independent of each other then (assuming e.g. we measure returns

logarithmically and that the portfolio and benchmark remain unchanged through

time) we can apply the square-root of time adjustment to derive ex ante

tracking errors applicable to different time periods, i.e.:

A portfolio’s ex-post tracking error is derived from

past observed values of its returns and might then be either a sample standard

deviation or (perhaps less accurately, but slightly lower) the corresponding

‘population’ standard deviation.

9.6 Drawdown

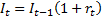

If a portfolio has exhibited past returns  over the previous

over the previous  time

periods (which could be days, weeks, months, years etc., where

time

periods (which could be days, weeks, months, years etc., where  is

earlier than

is

earlier than  etc.) then the

portfolio’s drawdown at time

etc.) then the

portfolio’s drawdown at time  is usually defined

to be

is usually defined

to be  (if negative). Its maximum

drawdown is usually defined as

(if negative). Its maximum

drawdown is usually defined as  (if negative). Its cumulative

maximum drawdown (i.e. peak-to-trough) at time

(if negative). Its cumulative

maximum drawdown (i.e. peak-to-trough) at time  is

usually defined by creating an index

is

usually defined by creating an index  such that

such that  and then

determining at time

and then

determining at time  the maximum of

the maximum of  for all

for all  and

and

.

.

9.7 Marginal VaR

The overall outcome of a portfolio of exposures containing a

(constant) amount  of exposure to the

of exposure to the  ’th

risk where each risk involves an random outcome

’th

risk where each risk involves an random outcome  (technically

(technically  is the value

ascribed to the random outcome) is

is the value

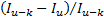

ascribed to the random outcome) is  . Strictly speaking

combining exposures in this manner requires that the way in which we ascribe a

financial value to an outcome satisfies the axioms of uniqueness, additivity

and scalability, i.e. that

. Strictly speaking

combining exposures in this manner requires that the way in which we ascribe a

financial value to an outcome satisfies the axioms of uniqueness, additivity

and scalability, i.e. that  , the value we

ascribe to an outcome should be unique and should satisfy

, the value we

ascribe to an outcome should be unique and should satisfy  .

.

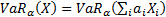

The VaR of such a portfolio with confidence level  is

is

.

.

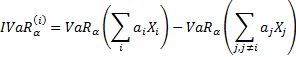

The marginal VaR with confidence level  of

the

of

the  ’th exposure in such

a portfolio is:

’th exposure in such

a portfolio is:

The contribution to overall VaR of the  ’th

exposure is then

’th

exposure is then  .

.

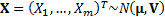

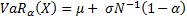

If the outcomes are Gaussian (i.e. multivariate normal, say  exposures

with

exposures

with  then

then where:

where:

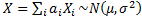

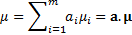

Here  and

and  . Given the

properties of the normal distribution

. Given the

properties of the normal distribution

As tracking error is a special case of VaR (with assumed

normal underlying distribution and  ,

,  ) we can likewise

define the marginal tracking error and contribution to tracking error from an

individual exposure.

) we can likewise

define the marginal tracking error and contribution to tracking error from an

individual exposure.

9.8 Incremental VaR

The incremental VaR with confidence level  of

the

of

the  ’th exposure in such

a portfolio is:

’th exposure in such

a portfolio is:

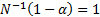

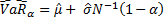

9.9 Estimating VaR

If the observations are normally distributed then  may be estimated

approximately in a parametric manner using

may be estimated

approximately in a parametric manner using  . Alternatively it

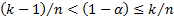

can be estimated (approximately) in a non-parametric manner (if the data does

not exhibit temporal dependencies) by taking the observations

. Alternatively it

can be estimated (approximately) in a non-parametric manner (if the data does

not exhibit temporal dependencies) by taking the observations  , say, reordering

them so that

, say, reordering

them so that  , say, identifying

the

, say, identifying

the  ’th order statistic,

where

’th order statistic,

where  is an integer

between 1 and

is an integer

between 1 and  , and estimating the

VaR using the

, and estimating the

VaR using the  ’th order statistic

where

’th order statistic

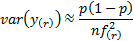

where  . Using a binomial

distribution, the variance of the

. Using a binomial

distribution, the variance of the  ’th order statistic

is approximately as follows (where

’th order statistic

is approximately as follows (where  is the pdf at

is the pdf at  and

and  is

the probability of outcome) meaning that estimating the standard error of this

non-parametric statistic requires us to estimate

is

the probability of outcome) meaning that estimating the standard error of this

non-parametric statistic requires us to estimate  :

:

NAVIGATION LINKS

Contents | Prev | Next