Enterprise Risk Management Formula Book

7. Interest rates and bond pricing

[this page | pdf | back links]

7.1 Spot and forward rates

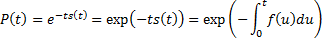

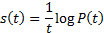

Suppose  is the price at

time 0 of a zero-coupon bond that pays 1 at time

is the price at

time 0 of a zero-coupon bond that pays 1 at time  ,

,

is the spot rate

for the period

is the spot rate

for the period  , i.e. 0 to

, i.e. 0 to  ,

and

,

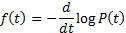

and  is the

instantaneous forward rate at time 0 for time

is the

instantaneous forward rate at time 0 for time  (where

(where

and

and  are both

continuously compounded) Then:

are both

continuously compounded) Then:

7.2 Duration,

modified duration, (gross) redemption yield (yield to maturity), credit spread,

option-adjusted spread, annualisation conventions

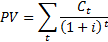

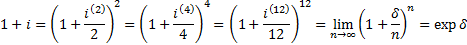

If a bond gives the holder entitlements to cash flows  at time

at time  (and

is assumed not to be subject to default risk) and has a ‘dirty price’,

(and

is assumed not to be subject to default risk) and has a ‘dirty price’,  ,

then its (gross) redemption yield (yield to maturity) is the (sensible) rate of

interest that equates

,

then its (gross) redemption yield (yield to maturity) is the (sensible) rate of

interest that equates  with its present

value, i.e.:

with its present

value, i.e.:

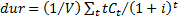

Its duration is then  and its modified

duration is

and its modified

duration is  .

.  is almost exactly

the same as its PV01, also called DV01.

is almost exactly

the same as its PV01, also called DV01.

Its credit spread is the difference between its (gross)

redemption yield and the corresponding yield on a reference security, often a

corresponding government security providing the same cash flows in the event of

non-default. The option-adjusted spread is the corresponding spread taking into

account optionality in the bond in question and/or in the reference bond.

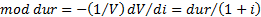

Interest rates may be expressed as

annual rates,  , semi-annual

rates,

, semi-annual

rates,  , quarterly rates,

, quarterly rates,  , monthly rates,

, monthly rates,  or even

continuously compounded rates,

or even

continuously compounded rates,  , where:

, where:

The quotation convention of a bond (e.g. ACT/ACT) defines

the amount of accrued interest payable when a bond is bought or sold in between

coupon dates.

NAVIGATION LINKS

Contents | Prev | Next