Enterprise Risk Management Formula Book

8. Financial derivatives

[this page | pdf | back links]

8.1 Forward prices

The no arbitrage (fair) forward price which parties should

agree to exchange a security at time  if it is

priced

if it is

priced  now and is

entitled to fixed income of present value

now and is

entitled to fixed income of present value  in the

meantime is:

in the

meantime is:

where  is the

interest rate (continuously compounded).

is the

interest rate (continuously compounded).

If instead it pays dividends at a rate  (continuously

compounded) then the forward prices is:

(continuously

compounded) then the forward prices is:

8.2 Black-Scholes formulae

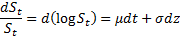

Geometric Brownian motion for a security (stock) price  involves

involves

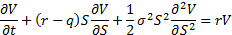

The partial differential equation satisfied by values of

payoffs involving such security prices is:

where  is the

interest rate,

is the

interest rate,  is the

dividend yield (both continuously compounded) and

is the

dividend yield (both continuously compounded) and  is

the security price volatility.

is

the security price volatility.

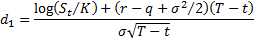

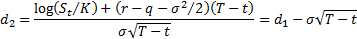

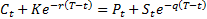

Garman-Kohlhagen formulae for values at time  of

European-style put and call options with strike price

of

European-style put and call options with strike price  maturing

at time

maturing

at time  :

:

where

We then have  , i.e. put-call

parity.

, i.e. put-call

parity.

Technically the Black-Scholes formulae

are special cases of the Garman-Kohlhagen formulae for stocks that pay no

dividend, i.e. have  , although

in practice the two names are normally treated as interchangeable.

, although

in practice the two names are normally treated as interchangeable.

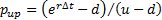

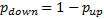

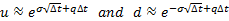

The Black-Scholes option pricing formulae can also be

derived as the limit of binomial trees (lattices) with movements  or

or  with an

up-step probability

with an

up-step probability  and a

down-step probability

and a

down-step probability  where:

where:

NAVIGATION LINKS

Contents | Prev | Next