Derivative Pricing – Cost of Capital

Pricing Model

[this page | pdf | references | back links]

1. A simple way of incorporating in derivative

pricing the possibility that investment markets might jump is to consider the

limiting (and therefore typically unrealistic) case where the price of the

underlying might jump to zero or infinity. This is the basis of the ‘cost of

capital’ developed by M.H.D. Kemp and A.D. Smith, see e.g. Kemp (1997) or

Kemp (2009).

2. This model assumes that in any small instant

the underlying may jump in price either infinitely upwards or down to zero. An

option writer is putting his or her capital at risk from such jumps as they are

not hedgeable by investing merely in the underlying and risk-free assets. It

is reasonable to assume that the option writer will demand an excess return on

the ‘risk capital’ that the option writer needs, to reflect this risk. Of

course, such risks can be hedged by buying suitable options, but this has

merely transferred the jump risk to someone else. Ultimately, someone must

carry this risk.

3. The model thus has two additional parameters

to those applicable to the Black-Scholes formulae, namely:

= the rate

of interest required on the cash the writer would need to hold to make good the

loss that he would incur if there were an extreme downward jump in the price of

the underlying shares and

= the rate

of interest required on the cash the writer would need to hold to make good the

loss that he would incur if there were an extreme downward jump in the price of

the underlying shares and

= the

enhanced income yield required on the shares the writer would need to hold to

make good the loss that he would incur if there were an extreme upward movement

in the price of the underlying shares

= the

enhanced income yield required on the shares the writer would need to hold to

make good the loss that he would incur if there were an extreme upward movement

in the price of the underlying shares

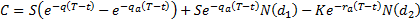

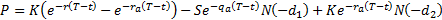

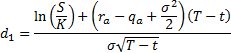

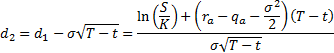

4. The values under this model of European put

options  and call

options

and call

options  are as

follows, see Kemp

(1997) for a derivation. They bear some resemblance to the formulae

applicable in the more basic Black-Scholes world (and reproduce them in the

special case where

are as

follows, see Kemp

(1997) for a derivation. They bear some resemblance to the formulae

applicable in the more basic Black-Scholes world (and reproduce them in the

special case where  and

and  ).

).

where:

5. The Nematrian website includes functions for

pricing European call and put options given the ‘cost of capital’ model, namely

MnCCCall and MnCCPut respectively. The ‘CC’

here refers to the cost of capital model, to differentiate the pricing model

from the basic Black-Scholes model, designated within the Nematrian web

services toolkit by ‘BS’.