Constrained Quadratic Optimisation: 6.

Portfolio optimisation

[this page | pdf | references | back links]

Return to

Abstract and Contents

Next

page

6. Portfolio

optimisation

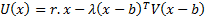

In a (mean-variance) portfolio optimisation context, the

objective that we typically want to maximise is the following (or some

monotonic equivalent):

Here  are the

portfolio weights (so typically we impose at least the following constraint

are the

portfolio weights (so typically we impose at least the following constraint  ),

),  is

the benchmark (or ‘minimum risk’ portfolio),

is

the benchmark (or ‘minimum risk’ portfolio),  is

a vector of assumed returns on each asset and

is

a vector of assumed returns on each asset and  is

the covariance matrix (

is

the covariance matrix ( , where

, where  is

the vector of risks on each asset class, here assumed to be characterised by their

volatilities, as this approach is merely a mean-variance one, and

is

the vector of risks on each asset class, here assumed to be characterised by their

volatilities, as this approach is merely a mean-variance one, and  their

correlation matrix).

their

correlation matrix).

NAVIGATION LINKS

Contents | Prev | Next