Calibrating probability distributions

used for risk measurement purposes to market-implied data: 3. Other comments

[this page | pdf | references | back links]

Return

to Abstract and Contents

Appendix

3. Other comments

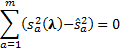

3.1 If  then the

simultaneous equations generated by the above procedure do not appear to have

analytic solutions, see e.g. the Appendix.

Instead they must in general be solved numerically by some iterative root

search algorithm, e.g. one that finds the value of

then the

simultaneous equations generated by the above procedure do not appear to have

analytic solutions, see e.g. the Appendix.

Instead they must in general be solved numerically by some iterative root

search algorithm, e.g. one that finds the value of  that

satisfies the following equation:

that

satisfies the following equation:

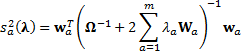

where:

If the problem involves a relatively small number of

instruments/calibration implieds then the problem can be solved using

relatively straightforward tools such as the Excel Solver add-in. For larger

instrument universes and/or calibration sets, more sophisticated root searching

algorithms may be needed.

3.2 However, it may not always be appropriate to

adopt a rote formulaic approach to calibration. For example, suppose we were

trying to calibrate a UK equity risk model. Easily observable implied volatilities

are available from listed equity derivatives on the FTSE100 index, the FTSE250

index but only for an incomplete range of individual equities. What should we

do for securities for which there are no readily available implied

volatilities?

3.3 The problem of incomplete or missing data is,

of course, a generic problem with calibration, and not specific to the above

problem. We could of course calibrate solely to those instrument volatilities

that are easily observable. However, this would typically disproportionately

affect the volatility assigned to the instruments included in the calibration

set, see Appendix. Suppose that in fact general levels of implied volatilities

are materially higher than those in the uncalibrated prior distribution, e.g.

because there is an overall perception within the market that the “world is

uncertain at the moment”. Would we want calibration disproportionately to mark

up volatilities of securities on which there were readily available option

prices versus those on which there were not?

3.4 An alternative would perhaps be to introduce

just two  ’s, i.e.

two calibration equations. One might calibrate the volatility of the main

market index to its current implied volatility (or actually in the spirit of

above the variance to its current implied variance). The other might calibrate

the average volatility (variance) of individual instruments to the average of

their individual implied volatilities (variances) to the extent that these

exist, with the same overall volatility (variance) adjustment then also applied

to instruments where there is no observable implied volatility. Or perhaps we

could adopt an intermediate approach of applying averaging within individual

sectors rather than across the market as a whole. Of course, such averaging

approaches would be less effective at calibrating individual instrument

volatilities so that they exactly matched their own implied volatilities where

these exist. That is the nature of averaging! We might also want to impose

further constraints on the calibration to force retention of any parsimonious

factor structure imposed on the prior distribution.

’s, i.e.

two calibration equations. One might calibrate the volatility of the main

market index to its current implied volatility (or actually in the spirit of

above the variance to its current implied variance). The other might calibrate

the average volatility (variance) of individual instruments to the average of

their individual implied volatilities (variances) to the extent that these

exist, with the same overall volatility (variance) adjustment then also applied

to instruments where there is no observable implied volatility. Or perhaps we

could adopt an intermediate approach of applying averaging within individual

sectors rather than across the market as a whole. Of course, such averaging

approaches would be less effective at calibrating individual instrument

volatilities so that they exactly matched their own implied volatilities where

these exist. That is the nature of averaging! We might also want to impose

further constraints on the calibration to force retention of any parsimonious

factor structure imposed on the prior distribution.

3.5 Analytical weighted Monte Carlo can also be

used to calibrate risk models to cater for different future time periods, as

long as there is a suitable term structure of implied volatilities available.

We merely need to repeat the exercise separately for each term. Again, if

necessary, ‘missing’ calibration data can be handled using averaging approaches

as per 3.4.

3.6 It is worth noting that calibration of risk

models to market implieds may make resulting ex ante tracking errors, VaR’s and

other similar risk measures more volatile (because implied volatilities are

themselves volatile over even quite short periods of time). This may be

important if explicit ex ante tracking error or VaR style risk limits are

present in investment management agreements. Use of risk statistics calibrated

to market implieds might then create greater likelihood of breach of such

mandate restrictions merely because of market movements. We could dampen the

impact of this ‘volatility of volatility’ by applying some sort of credibility

weighting to current implied volatilities versus volatilities extrapolated from

past history but of course only at the expense of calibration quality.

Alternatively, it might be appropriate to quote more than one set of risk

statistics, e.g. some ‘longer term’ ones (perhaps based solely on extrapolating

past history using a relatively long time window) and some ‘shorter-term’ ones

more fully calibrated to market implieds. The former might then be used more

for mandate limit purposes and the latter more for day-to-day management of the

portfolio.

NAVIGATION LINKS

Contents | Prev | Next