Calibrating probability distributions

used for risk measurement purposes to market-implied data: 2. Multi-instrument

calibration – Section Conclusion

[this page | pdf | references | back links]

Return

to Abstract and Contents

Next

Section

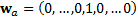

2.5 What in practice does this mean in the

n-instrument case? Suppose we wish to calibrate to  different

variances

different

variances  (

( ) exhibited

by instrument baskets described by vectors

) exhibited

by instrument baskets described by vectors  , where

each

, where

each  is a

vector of

is a

vector of  elements,

the first element of which is the weight in the basket of the first instrument

etc. For example, suppose we have implied volatilities for each instrument in

isolation and for an equally weighted portfolio of the instruments. We would

then have

elements,

the first element of which is the weight in the basket of the first instrument

etc. For example, suppose we have implied volatilities for each instrument in

isolation and for an equally weighted portfolio of the instruments. We would

then have  calibrations,

the first

calibrations,

the first  of

which involve weight vectors of the form

of

which involve weight vectors of the form  (with

the

(with

the  ’th

element of the weight vector being 1, other terms being zero) and the last

calibration having

’th

element of the weight vector being 1, other terms being zero) and the last

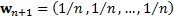

calibration having  . If

instead of calibrating to the implied volatility of an equally weighted basket

we wished to calibrate to the implied volatility of a market cap weighted index

implied volatility then

. If

instead of calibrating to the implied volatility of an equally weighted basket

we wished to calibrate to the implied volatility of a market cap weighted index

implied volatility then  would

be a vector of index weights.

would

be a vector of index weights.

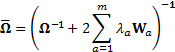

2.6 The calibrated probability distribution will

then have a covariance matrix as follows, where each  is an

is an  dimensional

matrix:

dimensional

matrix:

subject to the  calibration

equations

calibration

equations  .

.

2.7 As long as this problem is not ill posed (e.g.

because there are too many calibrations relative to the number of terms in the

covariance matrix, or because there are no feasible solutions to the equations)

calibration involves solving a set of  simultaneous

equations

simultaneous

equations  in

in  unknowns,

i.e. the

unknowns,

i.e. the  .

.

2.8 An example of such a calibration is set out in

the Appendix.

{/CalibratingPriorsToMarketImpliedData2c}

NAVIGATION LINKS

Contents | Prev | Next