Calibrating probability distributions

used for risk measurement purposes to market-implied data: 1. Introduction

[this page | pdf | references | back links]

Return

to Abstract and Contents

Next

Section

1. Introduction

1.1 Kemp (2005)

and Kemp (2009)

argue in favour of greater use of market-consistent

risk management. This involves greater focus on market implied probability

distributions and other risk parameters (consistent with the market prices of

derivatives that might protect against the relevant risks) and lesser focus on

estimating such parameters using time series analysis of historic market

behaviour.

1.2 In practice, as is explained in Kemp (2009),

there is insufficient market implied data available to be able to build up a full

specification of the relevant market implied probability distribution. However,

there is often some market implied data that we can use for calibration

purposes. We explain in these pages how we can combine this data with an

assumed prior distribution in a Bayesian or credibility-weighted type manner,

thereby deriving risk measures that are as market consistent as possible, but

still coloured by our prior views in cases where market implied data does not exist.

A natural prior to adopt in this context, if we think the historic data is

relevant, is one based on the relevant historic dataset.

1.3 A prototype methodology for market consistent

risk measurement is described in Kemp (2009)

involving an analytical weighted Monte Carlo, aka analytical relative

entropy approach. This involves identifying a distribution that is, in some

suitable sense, as ‘close as possible’ to the original prior distribution but

that has characteristics that match calibration characteristics derived from

market implied data (or otherwise).

1.4 As its name suggests, the analytical weighted

Monte Carlo methodology has its genesis in the weighted Monte Carlo simulation

approach, see Elices

& Gimenez (2006) and Avellandeda

et al (2001). In this approach, we calibrate a simulation exercise not by

changing the draws from some previously specified prior probability

distribution but by changing the assumed likelihoods ascribed to each draw in

the computation of statistics in which we are interested (e.g. mean, standard

deviation, other moments, quantiles etc.). Typically we choose these revised

likelihoods of occurrence to minimise the relative entropy between the

original prior distribution and the calibrated output distribution. The

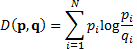

relative entropy between two discrete distributions  and

and  is given

by the following, where

is given

by the following, where  here

indexes the possible outcomes (the formula for continuous distributions is

derived in an analogous manner):

here

indexes the possible outcomes (the formula for continuous distributions is

derived in an analogous manner):

1.5 The analytical weighted Monte Carlo methodology

notes that in the limit where the number of simulations  we will

recover an exact output probability distribution and that in a number of cases

of interest this probability distribution can be expressed in ‘analytical’

form, i.e. we may be able to recover relatively simply what the methodology

would have produced had we been able to use an infinitely large Monte Carlo

sample size.

we will

recover an exact output probability distribution and that in a number of cases

of interest this probability distribution can be expressed in ‘analytical’

form, i.e. we may be able to recover relatively simply what the methodology

would have produced had we been able to use an infinitely large Monte Carlo

sample size.

1.6 In the special case of single instrument

calibration involving a univariate normal prior distribution, say,  we find,

as we might expect, that application of an analytical weighted Monte Carlo

returns a normal distribution with the following characteristics, see Kemp (2009):

we find,

as we might expect, that application of an analytical weighted Monte Carlo

returns a normal distribution with the following characteristics, see Kemp (2009):

(a) If we have no

market data whatsoever to calibrate to then the calibrated distribution is the

same as the prior distribution, i.e.  ;

;

(b) If we have just a mean

to calibrate to, say  , then

the calibrated distribution is

, then

the calibrated distribution is  ; and

; and

(c) If we have both

a mean and a variance to calibrate to, say,  and

and  , then

the calibrated distribution is

, then

the calibrated distribution is  .

.

For risk management purposes, it is usual to adopt the

assumption that the return on all assets is the same (i.e. to discount the

possibility of ‘manager skill’, because it is prudent to do so). It can be

argued that (b) provides the theoretical justification for this, i.e. in effect

we are ‘calibrating’ some assumed prior distribution (that might include

differential returns) to fit a constraint that requires any prior assumed

manager skill in asset selection not actually to be present in practice.Without

loss of generality the mean return can for the purposes of this paper be set to

zero (since our focus will be on relative returns). Hence our focus will be on

second and higher moments (or just second moments in the case of normally

distributed variables, which is the main focus of these pages).

NAVIGATION LINKS

Contents | Prev | Next