Black-Scholes option pricing greeks

[this page | pdf | references | back links]

We set out below links to pages containing analytical

formulae for the prices and greeks for (European-style) vanilla put and

call options and binary put and call options, in a Black-Scholes world,

see also e.g. Wilmott

(2007). The relevant pages contain links to pages that allow you to

calculate these prices and Greeks interactively or programmatically.

-

(Vanilla)

calls

-

(Vanilla)

puts

-

Binary

calls

-

Binary

puts

Notation

Throughout these pages we use the following notation:

Input parameters:

= strike price

= strike price

= price of underlying

= price of underlying

= interest rate

continuously compounded

= interest rate

continuously compounded

= dividend yield

continuously compounded

= dividend yield

continuously compounded

= time now

= time now

= time at maturity

= time at maturity

= implied volatility (of

price of underlying)

= implied volatility (of

price of underlying)

Formulae elements:

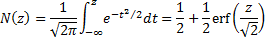

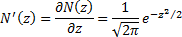

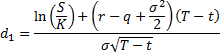

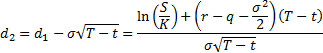

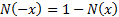

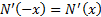

N.B.  and

and

.

.