Deriving the Black-Scholes Option Pricing

Formulae using Ito (stochastic) calculus and partial differential equations

[this page | pdf | references | back links]

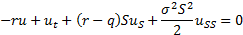

The following partial differential equation is satisfied by

the price of any derivative on  , given the assumptions

underlying the Black-Scholes world:

, given the assumptions

underlying the Black-Scholes world:

This partial differential equation is a second-order, linear

partial differential equation of the parabolic type. This type of

equation is the same as used by physicists to describe diffusion of heat. For

this reason, Gauss-Weiner or Brownian processes are also often commonly called diffusion

processes.

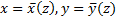

If  ,

,  and

and  are

constant then we can solve it by transforming it into a standard form which

others have previously solved, namely (for some constant

are

constant then we can solve it by transforming it into a standard form which

others have previously solved, namely (for some constant  ):

):

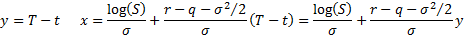

This can be achieved by replacing  by

by  where

where

(as long as

(as long as  is

constant) and by making the following double transformation (assuming that

is

constant) and by making the following double transformation (assuming that  ,

,  and

and  are

constant):

are

constant):

This transformation removes one of the terms in the partial

differential equation:

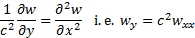

The partial differential equation then simplifies to  , with

, with  . Prices of different

derivatives all satisfy this equation and are differentiated by the imposition

of different boundary conditions. A common tool for solving partial

differential equations subject to such boundary conditions is the use of Green’s

functions. This expresses the solution to a partial differential equation

given a general boundary condition applicable at some boundary

. Prices of different

derivatives all satisfy this equation and are differentiated by the imposition

of different boundary conditions. A common tool for solving partial

differential equations subject to such boundary conditions is the use of Green’s

functions. This expresses the solution to a partial differential equation

given a general boundary condition applicable at some boundary  , formed say by the

curve

, formed say by the

curve  , as an expression of

the following form, in which

, as an expression of

the following form, in which  is called the Green’s

function for that partial differential equation:

is called the Green’s

function for that partial differential equation:

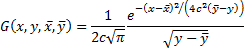

The Green’s function for  where

where  is

constant is:

is

constant is:

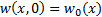

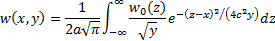

If the boundary condition is expressed as  at

at  , where

, where  is continuous and

bounded for all

is continuous and

bounded for all  , then the solution is:

, then the solution is:

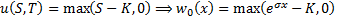

For a European call option, with strike price  , we

have, after making the substitutions described above,

, we

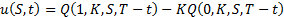

have, after making the substitutions described above,  . After some further

substitutions we find that this implies that:

. After some further

substitutions we find that this implies that:

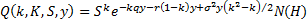

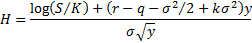

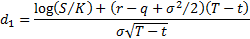

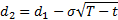

where:

Substituting  and

and  into the formula for

into the formula for  recovers the

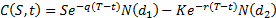

Black-Scholes formulae, e.g. for a call option:

recovers the

Black-Scholes formulae, e.g. for a call option:

Where

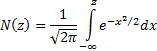

and  is the cumulative

Normal distribution function, i.e.

is the cumulative

Normal distribution function, i.e.