Valuing polynomial payoffs in a Black

Scholes World

[this page | pdf | back links]

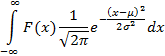

If the price of the underlying follows a Gauss-Weiner

process (as is the case in the Black-Scholes world) then valuation of a

derivative relating to a European-style payoff would appear to involve

calculating the following integral, where  is the payoff

function:

is the payoff

function:

Any payoff can be approximated arbitrarily accurately using

combinations of piecewise polynomials. Even payoffs with discontinuities (e.g.

digital options) can be approximated by combinations of value functions and

(multiple) indicator pairs, where the pairs define the domain over which the

relevant payoff function applies.

However, it is important to realise that prior to the

representation of the pricing problem in the above format there is a

transformation of variables that complicates how in practice this integral

should best be evaluated.

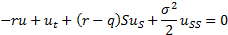

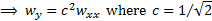

The partial differential equation satisfied by any

derivative in a Black-Scholes world is:

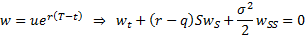

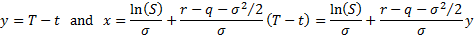

We can convert this equation into a standard form with  using the

following transformations:

using the

following transformations:

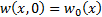

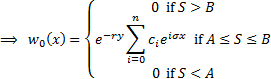

To value European style payoffs we need to solve an initial

value or Cauchy problem. If the boundary condition is  at

at  ,

where

,

where  is continuous

and bounded for all

is continuous

and bounded for all  then the solution

becomes:

then the solution

becomes:

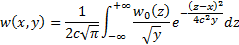

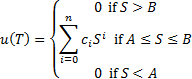

Suppose that the payoff has the following general form:

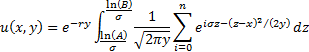

The solution to the pricing problem is thus:

The original polynomial elements in the payoff function are

thus transformed into exponential terms in final integral representation.