Annualisation Conventions: 1.

Introduction

[this page | pdf | back links]

Return to

Overview

Next section

A statement from a bank

or insurer that a deposit will be credited with interest at the rate of 10% per

annum may sound unambiguous. In fact it is not. Interest rates and yields (and

hence spreads between different interest rates) can be quoted in a variety of

ways.

First we note that market

interest rate levels will differ according to the term of the deposit. Thus in

practice we might find that the interest rate credited on 1 year deposits is 5%

per annum, but on 2 year deposits is 6% per annum, say. This dependency on time

is called the ‘yield curve’. Interest bearing bonds will have a ‘running’ (or

‘coupon’) yield, which is the interest per unit nominal received each year.

However, as their price may not be at par, attention is more usually focused on

their ‘redemption yield’, i.e. the rate of return needed to equate their

current value with the present value of all future payments, both income and

redemption proceeds. With equities, which pay uncertain levels of dividends,

the ‘dividend yield’ may refer to the current dividend rate divided by the

current price. The ‘rental yield’ is a corresponding term that is used for

property, i.e. real estate, referring here to the rental income that the

property might provide. All of the above may be quoted gross or net of tax if

relevant (and potentially also gross or net of other types of expenses).

However these various

definitions of yield still do not exhaust the range of meanings that can be

placed on a quoted interest rate. In particular, the meaning to be ascribed to

any particular interest rate depends on the ‘annualisation convention’ being

adopted.

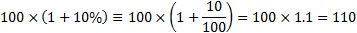

If, say, a 10% per annum

interest rate is being quoted with annual compounding the statement

that the interest rate is 10% per annum means that at the end of one year 100

grows to:

To be meaningful we of

course also need to specify the currency (or more generally the ‘numeraire’) in

which value is being expressed, e.g. US$, GB£, Euro, Yen, ....

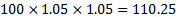

However, when the

interest rate is expressed with semi-annual compounding, then the

statement means that we earn 5% every six months. This means that at the end of

one year 100 grows to:

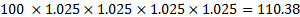

When the interest rate is

expressed with quarterly compounding, then the statement means that we

earn 2.5% every 3 months. This means that at the end of one year 100 grows to:

We can generalise these

results by supposing that an amount  is invested for

is invested for  years

at an interest rate of

years

at an interest rate of  that is compounded

that is compounded  times

per annum. The terminal value of the investment is then:

times

per annum. The terminal value of the investment is then:

The limit as  is

called continuous compounding. The terminal value is then:

is

called continuous compounding. The terminal value is then:

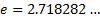

Here  , also called

, also called  or

or  , is the exponential

function, i.e.

, is the exponential

function, i.e.  raised to the power

of

raised to the power

of  . The continuously

compounded interest rate (sometimes also called the force of interest)

equivalent to a 10% annually compounded interest rate is thus:

. The continuously

compounded interest rate (sometimes also called the force of interest)

equivalent to a 10% annually compounded interest rate is thus:

The difference between

interest rates quoted with different annualisation conventions increases the

further the interest rate deviates from 0%, as is illustrated in Table 1. For

most practical purposes, continuous compounding can be thought of as equivalent

to daily compounding.

NAVIGATION LINKS

Contents | Prev | Next