Solvency II Standard Formula SCR: Market

Risk Module – Correlations

[this page | pdf | references | back links]

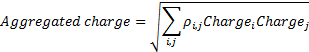

In the standard formula SCR computation individual

sub-component capital charges (or individual component charges) are typically

aggregated using a correlation coefficient based approach. This involves

calculating the overall charge using a formula along the lines, where  is the capital

charge for a given component element:

is the capital

charge for a given component element:

In the case of the market risk module, the correlations

proposed changed as the consultation process developed. For example, the Level

2 guidance from CEIOPS (EIOPA’s predecessor) introduced different correlations

between interest rate risk and some of the other subcomponents included in the

market risk module depending on whether the interest rate risk that applied

involved a fall in interest rates or a rise in interest rates. The

justification was that there was stronger support for a positive correlation

(with falls in equity values, falls in property values or spread movements) in

the case of falling interest rates than in the case of rising interest rates.

This approach has been retained in the correlations specified in DA

Article 164.

The Nematrian website makes available the following tools to

help manipulate these correlations:

(a) MnSolvencyII_SCRSFStressSetNames.

Indicates acceptable stress set names (e.g. “DA” for the correlations contained

in the Delegated

Act).

(b) MnSolvencyII_SCRSFMktStressNames.

Indicates acceptable stress names for a given StressSetName. For DA this

includes an ‘interest rate (down)’ and an ‘interest rate (up)’ rather than

merely ‘interest rate’.

(c) MnSolvencyII_SCRSFMktCorrs.

Provides an array containing the correlation matrix. If there are  different

stress names then is an array with

different

stress names then is an array with  terms, ordered

consistently with the ordering of the stress names given in (b).

terms, ordered

consistently with the ordering of the stress names given in (b).

(d) MnSolvencyII_SCRSFCombineStresses.

Combines different stresses using the correlation matrix and stress names as

above. Works for other sub-modules as well as the market risk module. For e.g.

DA one or other of the ‘interest rate (down)’ and ‘interest rate (up)’ stresses

needs to be zero.

Version dated 7 December 2015

NAVIGATION LINKS

Contents | Prev | Next