Solvency II Standard Formula SCR:

Counterparty Default Risk Module – Type 1 Risk

[this page | pdf | references | back links]

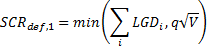

The final Solvency II Delegated

Act, like the earlier CEIOPS Level 2 guidance, subdivides counterparty

exposures into two types. Type 1 aims to cover exposures primarily of the sort

that might well not be diversified and where the counterparty is likely to be

rated (e.g. reinsurance arrangements). It involves a formula along the

following lines:

where:

=

loss-given-default for type 1 exposure of counterparty

=

loss-given-default for type 1 exposure of counterparty

=

3 or 5 depending on how big

=

3 or 5 depending on how big  is in relation to

is in relation to

(based on the

earlier CEIOPS Level 2 guidance the 3 seems to assume a lognormal distribution)

(based on the

earlier CEIOPS Level 2 guidance the 3 seems to assume a lognormal distribution)

=

deemed variance of the loss distribution of the type 1 exposures, calculated as

below

=

deemed variance of the loss distribution of the type 1 exposures, calculated as

below

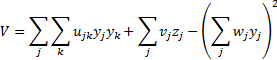

is in effect calculated

as follows (although the formulae specified in the Delegated

Act less clearly brings this out than the formulae in the earlier CEIOPS

Level 2 guidance), subdividing exposures by rating class, where

is in effect calculated

as follows (although the formulae specified in the Delegated

Act less clearly brings this out than the formulae in the earlier CEIOPS

Level 2 guidance), subdividing exposures by rating class, where  and

and

run through each

rating class and

run through each

rating class and  ,

,  and

and  are parameters

which depend on rating classes.

are parameters

which depend on rating classes.

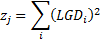

where the  and

and  are to be

calculated summing over all independent counterparties

are to be

calculated summing over all independent counterparties  in

rating class

in

rating class  :

:

As with the Type 2

exposures, the impact of possible recoveries should be taken into account when

assessing exposures, see e.g. loss-given-default

adjustments.

7 December 2015

NAVIGATION LINKS

Contents | Prev | Next